| “Our community is expanding: MRZine viewers have increased in number, as have the readers of our editions published outside the United States and in languages other than English. We sense a sharp increase in interest in our perspective and its history. Many in our community have made use of the MR archive we put online, an archive we plan to make fully searchable in the coming years. Of course much of the increased interest is from cash-strapped students in the metropolis, and from some of the poorest countries on the globe. For those of us able to help this is an extra challenge. We can together keep up the fight to expand the space of socialist sanity in the global flood of the Murdoch-poisoned media. Please write us a check today.” — John Bellamy Foster

To donate by credit card on the phone, call toll-free: You can also donate by clicking on the PayPal logo below: If you would rather donate via check, please make it out to the Monthly Review Foundation and mail it to:

Donations are tax deductible. Thank you! |

In Marxian terms, the current crisis emerged from the workings of the capitalist class structure. Capitalism’s history displays repeated booms and busts punctuated by bubbles. Capitalism’s cycles range unpredictably from local, shallow, and short to global, deep, and long. To keep capitalism is to suffer its chronic instability. To deal effectively with capitalism’s recurring crises requires changing to a non-capitalist class structure.

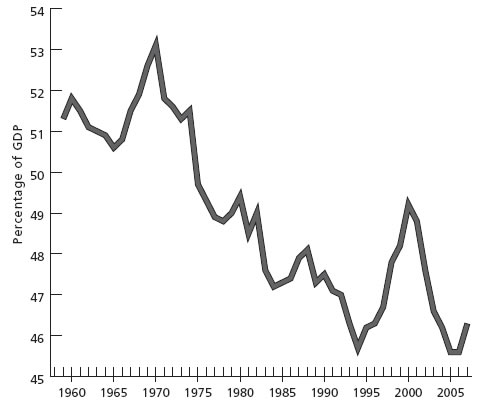

Wages as Percentage of GDP SOURCE: John Bellamy Foster and Fred Magdoff, “Financial Implosion and Stagnation: Back to The Real Economy,” Monthly Review 60.7, December 2008 |

Since the mid-1970s, workers’ average real wages stopped rising. This was partly because capitalists’ computerization of production displaced workers. Capitalists also decided then to move more production to foreign countries for higher profits. Since employers thus needed fewer workers in the US, they could and did end the historic (1820-1970) rise of US wages.

However, workers’ productivity kept rising (more machines, more pressure, and more skills). They produced ever more for their employers to sell, yet the employers paid them no more. The surpluses extracted (exploited) by capitalist employers — the excess of the value added by each laborer over the value paid to that laborer — rose. The last 30 years realized capitalists’ wildest dreams. Yet, stagnant wages and booming surpluses also eventually plunged US capitalism into today’s severe crisis.

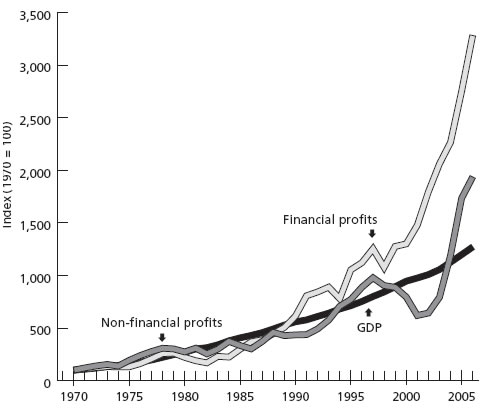

SOURCE: Chris Monasterski, “Higher Returns or Creative Accounting?” Private Sector Development Blog, World Bank, 24 August 2008 |

Today’s major capitalists — corporate boards of directors — received most of those fast rising surpluses. How they distributed those surpluses shaped our history. One huge portion went for top executives’ payouts. Another portion increased dividends to corporations’ shareholders (who, after all, elect boards of directors). Still other portions financed the transfer of production abroad, enhanced computerization to reduce payrolls, and lobbying for favorable state actions (e.g., reducing corporate taxes and allowing more immigration to lower wages).

Growth of Financial and Nonfinancial Profits Relative to GDP (1970=100) SOURCE: John Bellamy Foster and Fred Magdoff, “Financial Implosion and Stagnation: Back to The Real Economy,” Monthly Review 60.7, December 2008 |

Corporations deposited mounting surpluses in banks. Banks grew and invented new financial instruments to profit further from those surpluses. New instruments included securities such as “collateralized debt obligations” (comprised of mortgage, credit card, corporate, and student-loan debt); “credit default swaps” (deals to insure such new securities); and other “derivatives” for trading the risks of fast multiplying new credit instruments among those with the surpluses to invest. Because the new instruments operated completely outside existing regulations in a “shadow credit system” ever bigger risks were undertaken for ever bigger profits. Specialized enterprises such as hedge funds arose to invest rising corporate surpluses and exploding executive incomes in the murky shadows of high finance. Huge profits were made over the last 20 years, but the resulting capitalist exuberance once again overreached its limits.

The financial profits depended on the rising surpluses that depended on the stagnant wages. Financial profits also depended on the flip side of stagnant wages, namely massive worker borrowing. Because rising consumption had become the measure of personal success in life, wage stagnation since the 1970s rendered most US workers extraordinarily vulnerable to new consumer credit offers. Enter the banks relentlessly pushing credit cards, home equity loans, student loans, and so on. Workers undertook a record-breaking debt binge. The banks packaged that debt into new securities (the now infamous MBSs and CDOs) and sold them to all those seeking investments for their pieces of the soaring surpluses.

In effect, US capitalism thereby substituted rising loans for rising wages to workers. It took from them twice: first, the surplus their labor produced; and second, the interest on the surpluses lent back to them. This double squeeze on workers was the foundation of the US boom from the 1970s to 2006.

Eventually, the rising costs of the double squeeze’s strangled the boom. Families’ rising indebtedness meant that illnesses, job losses, divorces now yielded the added tragedy of defaults on debts. Rising steadily and ominously across 2007, defaults on credit card debt, auto loans, student loans, and mortgages took off in 2008. The new kinds of securities based on workers’ debts began to lose value in the markets. Banks, hedge funds, and others holding those securities faced mounting losses. Corporations that insured those securities via credit default swaps, etc., could not pay when so many securities’ values collapsed. Banks had used their depositors’ money and borrowed still more to buy such securities. Banks’ losses prevented repaying those loans or guaranteeing their depositors’ money. Financial markets froze as borrowers and lenders stopped trusting one another and drastically reduced transactions. Bust followed bubble followed boom, once again.

US corporate boards of directors had taken three interconnected steps to produce that sequence. They froze workers’ real wages, they extracted much more surplus from their rising productivity, and they distributed that rising surplus in ways that were cumulatively unsustainable. Irrational capitalist exuberance once again overreached its limits. The capitalist system of producing and distributing surpluses proved itself yet again fundamentally crisis-prone.

Had this capitalist system been replaced by another, say one in which the workers who produced the surpluses in each enterprise also functioned as the collective appropriator and distributor of those surpluses, US history since the 1970s would have differed greatly. Workers appropriating their own surplus would likely NOT have frozen their real wages (hence no exploding consumer debt). Workers who collectively appropriated their own surpluses would likely NOT have given immense new payouts to top managers. The distribution of personal income would thus NOT have become so unequal across the last thirty years. Workers appropriating their own surpluses would likely NOT have devoted huge portions of them to move their jobs overseas. And so on.

Of course, such a class structure would have its own contradictions and problems. It would interact with political institutions in ways different from how capitalist class structures do. Gender equality, environmental sustainability, and many other issues would still need attention, but they would not be aggravated, for instance, by the aforementioned double squeeze.

Thus the urgent questions are: Will responses to this latest capitalist crisis continue to ignore or deny the role of capitalism’s class structure? Will the crisis consequences of allowing capitalist boards of directors to appropriate and distribute surpluses go unrecognized? If so, the personal, political, economic, and cultural losses inflicted by this latest capitalist crisis will fail to teach their key lesson: a genuine solution requires progress beyond the capitalist class structure.