Introduction

The Venezuelan economy has grown more than 94 percent since the current expansion began in the second quarter of 2003.1 The overwhelming bulk of this growth has been in the non-oil sector.2 Throughout most of these five and a half years of unprecedented growth, the economy has often been characterized as an “oil boom about to go bust,” and predictions of collapse have been commonplace and often repeated. These have become more numerous of late since oil prices have fallen nearly 50 percent from a peak of over $130 in July to their current $64.48 per barrel.3 The current financial crisis, worldwide stock market collapse, and recession in the United States, Europe, and Japan have also added to gloomy predictions for the region, including Venezuela.

Venezuela does not receive any significant foreign investment from the United States or other countries that have been hard-hit by the financial crisis and economic slowdown. The most important, and practically the only, direct impact of these external events on Venezuela is through oil prices. Petroleum exports are currently about 93 percent of Venezuela’s exports.4

The relevant question for Venezuela is therefore how far oil prices would have to fall before the country would begin to run an unsustainable current account deficit. This is the binding constraint for developing countries. In other words, the United States, Europe, and Japan will — inasmuch as they choose to do so — pursue expansionary monetary and fiscal policies, including deficit government spending, in order to counteract the current recession. Developing countries can and ideally should do the same, but unlike these rich countries, they face a constraint due to the fact that their national currencies are not “hard” currencies. Therefore they cannot count on being able to borrow nearly as much, relative to GDP, or for so long a period of time, as countries with hard currencies, to cover their import needs. For this reason, the current account5 — not the central government budget, which can be covered in local currency — is the most important and binding constraint on developing countries such as Venezuela in the present situation.

We therefore look at current and projected exports and imports under a range of possible oil prices.

Exports

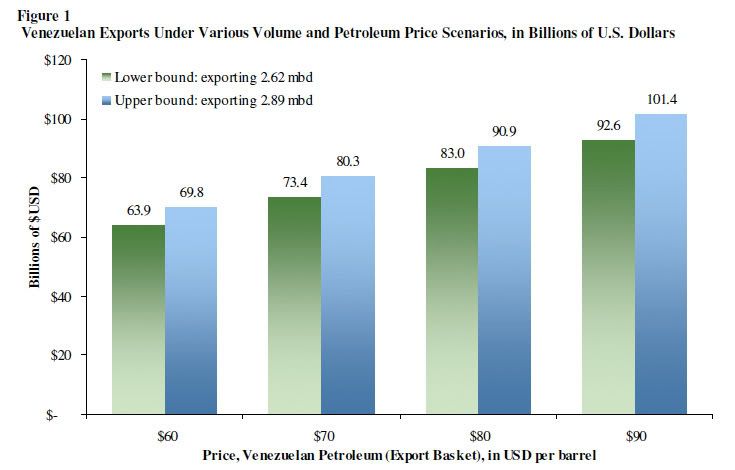

Figure 1 shows Venezuelan export revenues under various oil price scenarios. For simplicity, we assume that non-oil exports, which are about seven percent of export revenues, remain constant at $6.5 billion per year.6

Source: Venezuelan Central Bank (2008) and authors’ calculations.

Note: Sums include $6.5 billion USD in annual non-petroleum exports.

The Upper Bound: 2.89 Million Barrels per Day

For the volume of exports, we show export levels of 2.62 and 2.89 million barrels per day. The larger number is reported in PDVSA’s most recent financial report.7 There has been some dispute about how much oil Venezuela exports, with some press reports claiming that the true number is as low as 1.7 million barrels per day.8 In order to check the accuracy of PDVSA’s reporting, we first compared PDVSA’s export numbers with import figures for the largest countries that import oil from Venezuela. The US Energy Information Administration reports OECD imports from Venezuela to be 2.0 million barrels per day. In an independent financial statement, PDVSA reports exporting the same amount to OECD countries.9 China is the other large market for Venezuelan petroleum. While China has not released complete import figures for 2007 or 2008, the Chinese Ministry of Commerce reported in May of 2008 that China was importing 350 thousand barrels per day from Venezuela in 2007, which matches PDVSA’s reported exports to China.10 Thus, there does not appear to be any basis for the claim that Venezuela’s oil exports are overstated by PDVSA. We take PDVSA’s reported exports, 2.89 million barrels per day, as the upper bound of export volume, as shown in Figure 1.

The Lower Bound: 2.62 Million Barrels per Day

With PDVSA’s reported export volume confirmed, the only remaining necessary adjustment is to account for PetroCaribe, a program that sells oil on credit, with highly favorable financing terms, to 13 Caribbean nations. Since at least some of this oil does not generate current revenue, and the purpose of the accounting in this paper is to estimate Venezuela’s current account balance, we can subtract some of this oil from the export totals. No more than half of the oil exported through PetroCaribe is financed through deferred payments, so we can discount half of Venezuela’s exports to the Caribbean region, in order to derive a conservative estimate for a lower bound of export volume.11

PDVSA’s most recent financial statement puts exports to Caribbean countries at 0.54 million barrels per day. Subtracting half of this amount (0.27 million barrels per day) from our upper bound gives a lower bound of 2.62 million barrels per day.

Figure 1 shows Venezuela’s export revenue based on these two estimates of oil export volume, for prices ranging from $60 to $90 per barrel for Venezuela’s oil. Venezuela’s oil sold for 10.4 percent less than the benchmark West Texas Intermediate (WTI) price in 2007.12 The current price for WTI oil is $65.66; estimates from Goldman Sachs, Merrill Lynch, and the International Energy Agency predict WTI prices of between $80 and $100 per barrel for 2009.13

Imports and Trade Balances

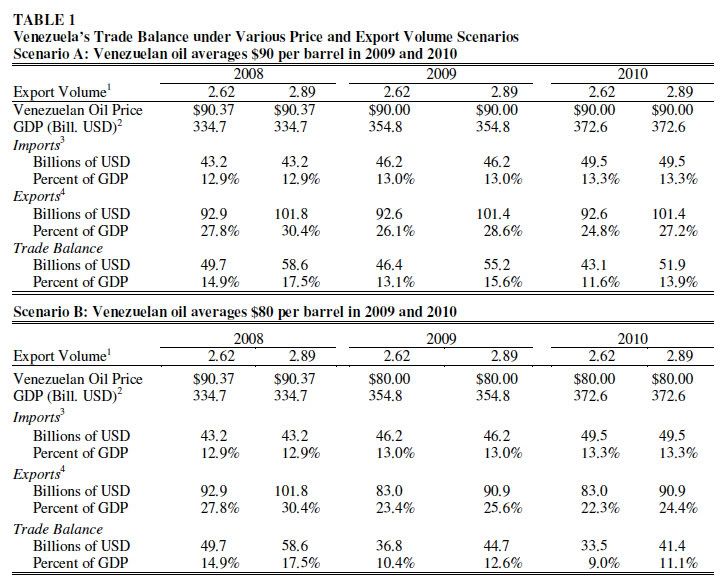

Table 1 shows the import side of the equation, and the current account results, under a variety of oil price scenarios. Imports for 2008 are running at an annual rate of $43.2 billion. If the price of Venezuelan oil stays approximately the same for the next two months, then the average price for 2008 will be $90.37, thus providing export revenue of 92.9 to 101.8 billion dollars for 2008, corresponding to exports of 2.62 to 2.89 million barrels per day.14 This would yield a trade surplus of 49.7 to 58.6 billion dollars for 2008, or an enormous 14.1 to 17.5 percent of GDP, assuming $43.2 billion in imports.

For 2009, taking first the high range of projected prices for Venezuela’s oil — $90 — we get export revenue of between $92.6 to 101.4 billion (again based on 2.62 to 2.89 barrels per day). This results in a trade surplus of between $46.4 and 55.2 billion , or a very large 13 to 16 percent of GDP.15 (For these estimates we assume that imports grow by 7 percent annually). For 2010, we get a trade surplus between $43.1 and 51.9 billion, or 11.6 to 13.9 percent of GDP.16

Sources: IMF (2008), Venezuelan Central Bank (2008), author’s calculations.

Notes:

1. Export volume is measured in millions of barrels per day.

2. If Venezuelan oil continues at its latest week’s average price, $52.96, through the rest of 2008, the year’s average will be $90.37

3. GDP estimates reflect the IMF World Economic Outlook database GDP estimate for 2008, and GDP growth estimates for 2009 and 2010.

4. Import estimates assume an annual 7 percent increase. However, the results are not changed substantially if imports were to increase by 10 percent annually.

5. These figures include US$6.5 billion in non-petroleum exports.

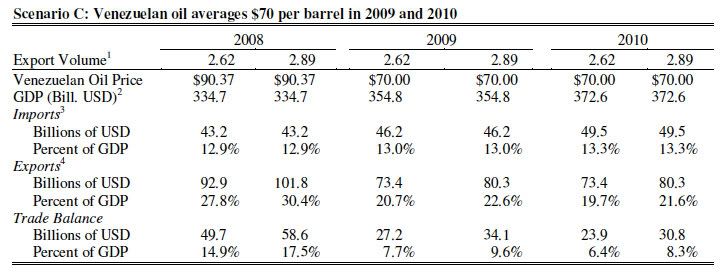

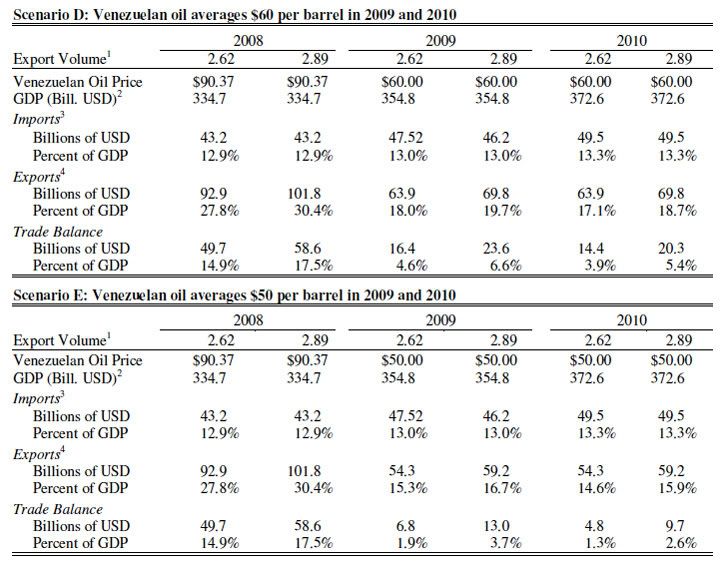

As can be seen in Table 1, if the price of Venezuelan oil falls to $80 a barrel, the country would still run a huge trade surplus of 10.4 to 12.6 percent of GDP for 2009, and 9.0 to 11.1 percent of GDP for 2010. At $70 a barrel, this surplus is still large at 7.7 to 9.6 percent of GDP for 2009, and 6.4 to 8.3 percent of GDP for 2010. At $60 a barrel, this surplus is reduced to 4.6 to 6.6 percent of GDP for 2009, and 3.9 to 5.4 percent of GDP for 2010.

Even at $50 per barrel, Venezuela would still run trade surpluses through 2010. However, this is considered to be an extremely unlikely scenario by economists who forecast oil prices.17

The current account surplus for 2007 was $20.0 billion, as compared to a trade surplus of $23.7 billion. Thus, including the other items in the current account does not alter the basic picture. Venezuela’s foreign debt is only nine percent of GDP, and interest payments on the debt are 2.2 percent of GDP, or currently $7.4 billion annually.18 There are no principal payments due on global bonds either this year or next.

It is clear that Venezuela can be expected to run current account surpluses for the foreseeable future, even at oil prices far below the levels that are currently forecasted by any experts in the field. However, even if the economy were to somehow fall into a current account deficit, the government has $40 billion in reserves at the Central Bank and another $37 billion in other hard currency assets.19 These reserves amount to 23 percent of GDP, thus providing an enormous cushion for any unanticipated events.

Conclusion

In light of the above data, it is difficult to foresee a scenario in which oil prices would fall far enough for Venezuela to run up against foreign exchange constraints due to loss of export revenue. Clearly there is also room for imports to grow faster than we assumed here, and Venezuela would still have large current account surpluses under foreseeable scenarios. It is also worth noting that we are assuming growth of five to six percent of GDP for the next two years. If the economy grows more slowly — as the IMF and some other economists have forecast — the current account surplus would be even larger, since demand for imports would shrink. Finally, the Venezuelan government also controls access to foreign exchange, and could limit the growth of imports if it needed to, although there would not seem to be any need for this in the foreseeable future.

For these reasons, the government should be fully able to pursue an expansionary fiscal policy in order to make up for any slowdown in consumer or capital spending, and keep the economy growing at a healthy pace. Problems with inflation can be expected to subside, since the price of imported goods can be expected to fall as a result of a rapidly decelerating global economy. The price of food commodities has dropped dramatically alongside of oil.20 Although as noted above there are few direct transmission mechanisms of the global financial crisis and economic slowdown to the Venezuelan economy, the first half of 2008 has shown a fall in capital spending (some of which appears to be government capital spending). Also there will be likely be some cutbacks in private spending due to falling confidence in the regional and world economy generally.

It is therefore important that the government consider taking the appropriate fiscal stimulus measures, including deficit spending as necessary, to avoid unnecessary declines in the rate of growth of output and employment. In the past, developing countries have too often taken procyclical measures — i.e. tighter fiscal and monetary policies — that have worsened economic slowdowns brought on by external shocks. An important exception has been China, which grew rapidly right through the last major financial crisis (1998-2000) while its neighbors suffered huge losses in output and employment. China’s success was a result of expansionary fiscal and monetary policy, especially the hundreds of billions of dollars that the government invested in infrastructure during this period. China is now pursuing similar policies in response to the current world slowdown; this week the government announced a $587 billion stimulus package — about 7 percent of GDP — over the next two years.

As noted above, developing countries have often been held back from pursuing the appropriate fiscal and monetary policies in the face of slowing aggregate demand, due to foreign exchange constraints. It is clear from the above data that Venezuela is far from experiencing such constraints and is unlikely to run into them in the foreseeable future.

1 Banco Central de Venezuela (2008).

2 Weisbrot and Sandoval (2008).

3 Venezuelan Energy and Petroleum Ministry (2008).

4 Banco Central de Venezuela (2008).

5 The current account balance is dominated by the trade balance, i.e. exports of goods and services minus imports; there are other items including debt service payments which will be accounted for below.

6 Non-petroleum exports were $6.61 billion USD in 2007 and $6.77 billion USD in 2006. (Banco Central de Venezuela, 2008). Figures are shown in US dollars unless otherwise noted.

7 PDVSA (2008).

8 For example, Forero (2008) reports that “most oil analysts put the [production] figure below 2.4 million, with more than 700,000 barrels of that sold daily in Venezuela at subsidized prices.”

9 US Energy Information Administration (2008a), PDVSA (2007). The EIA figures include the U.S. Virgin Islands but not the Dutch Antilles. The PDVSA figures are listed separately for each country, allowing a recreation of the EIA’s list.

10 PDVSA (2007), People’s Republic of China, Ministry of Commerce (2008).

11 PDVSA reports a proposed “financing scale between 5% and 50% of the oil bill” for PetroCaribe (PDVSA, n.d.)

12 Venezuelan Energy and Petroleum Ministry (2008).

13 Goldman Sachs (2008), Goldstein (2008), IEA (2008).

14 These figures include US $6.5 billion in non-petroleum exports (Banco Central de Venezuela, 2008).

15 This reflects a conservative estimate that GDP growth slows from 8.4 percent (2007 to 2008) to 6 percent (2008 to 2009) and then 5 percent (2009 to 2010).

16 Agence France-Press (2008), Lewis and Lawler (2008), and Lesova (2008).

17 See note 12, above.

18 Finance Ministry (2008), IMF (2008).

19 Banco Central de Venezuela (2008), Bancaribe (2008).

20 Reuters/Jefferies CRB Index (2008).

References

Agence France-Presse. 2008. “IEA Sees 100-Dollar Oil, Urges Massive Effort and Change on Energy.” November 6. .

Bancaribe. 2008. “Informe Económico Mensual.” Vol. 84. September.

Economist. “An Axis in Need of Oiling.” October 23.

Forero, Juan. 2008. “Oil-Fueled Nation Feels Pinch.” Washington Post. October 19.

Goldman Sachs . 2008. “Price Actions, Volatilities and Forecasts.” Energy Weekly. October 24.

Goldstein, Steve. 2008. “Merrill Lynch Cuts 2009 Oil Price Forecast.” MarketWatch. October 2.

IMF (International Monetary Fund). 2008. “World Economic Outlook Database.” October 2008.

IEA (International Energy Agency). 2008. “Executive Summary.” World Energy Outlook. Paris: IEA.

Lesova, Polya. 2008. “IEA Sees Oil Prices Surging to $100 a Barrel.” MarketWatch. November 6.

Lewis, Barabara and Alex Lawler. 2008. “IEA Sees Oil Above $100, Recognizes Supply Limit.” Reuters. November 6.

Mander, Benedict. 2008. “Oil Prices Leave Venezuela’s Chávez Vulnerable.” Financial Times. October 22.

New York Times. 2008. “OPEC’s Woes.” Editorial, October 27.

OPEC (Organization of the Petroleum Exporting Countries). 2008. Monthly Oil Market Report.

Painter, James. 2008. “Is Venezuela’s Oil Boom Set to Bust?” BBC News. October 28.

PDVSA (Petróleos de Venezuela, S.A.). No Date. “PetroCaribe.”

PDVSA (Petróleos de Venezuela, S.A.). 2007. Información Financiera y Operacional al 31 de diciembre de 2007.

PDVSA (Petróleos de Venezuela, S.A.). 2008. Información Financiera y Operacional 30 de junio de 2008.

People’s Republic of China, Ministry of Commerce. 2008. “China Teams up With Venezuela to Produce, Refine Heavy Oil.” Press Release.

Reuters/Jefferies CRB Index. 2008.

US Energy Information Administration. 2008b. “Short Term Energy and Winter Fuels Outlook,” October.

US Energy Information Administration. 2008a. “International Petroleum Monthly: Petroleum (Oil) Imports.”

Venezuelan Central Bank (Banco Central de Venezuela). 2008. “Indicadores.”

Venezuelan Energy and Petroleum Ministry (República Bolivariana de Venezuela, Ministerio del Poder Popular para la Energía y Petróleo). 2008. “Precios del Petróleo: Evolución de Precios 2007-2008.”

Venezuelan Finance Ministry (República Bolivariana de Venezuela, Ministerio del Poder Popular para las Finanzas. 2008. “Stock of External Public Debt.” June 30.

Walter, Matthew and Steven Bodzin. 2008. “Chavez Ambitions in Venezuela May Fade With Oil Price.” Bloomberg News. October 27.

Weisbrot, Mark and Luis Sandoval. 2008. “Update: The Venezuela Economy in the Chávez Years.” Washington, DC: Center for Economic and Policy Research. (February).

Mark Weisbrot is Co-Director and an Economist and Rebecca Ray is a Research Assistant at the Center for Economic and Policy Research in Washington, DC. The authors would like to thank Luis Sandoval and Dan Beeton for editorial and research assistance. This article was first published by the CEPR on its website (November 2008). Download the paper in PDF at <cepr.net/documents/publications/venezuela_2008_11.pdf>.

|

| Print