Introduction

The stimulus bill that President Obama pushed through Congress in the first month of his presidency was an important first step in counteracting the economic downturn. However, as many analysts have noted, it is not likely to be sufficient to turn around the economy. Economic and fiscal data only available after the passage of the bill provide strong support for this view. There are two main reasons why the stimulus bill is even more inadequate than is generally recognized:

- The negative economic impact of the housing bubble is larger than anticipated when the stimulus bill was enacted. The direct and indirect impact of the collapse of both the housing bubble and a bubble in non-residential real estate is far larger than the size of this stimulus package.

- Budget shortfalls at the state and local level — and, as a result, state and local spending cuts and tax increases — are larger than anticipated when the stimulus bill was enacted. When the most recent estimates of cutbacks at the state and local level are taken into account, the net stimulus coming from the government sector in calendar years 2009 and 2010 will be considerably less than has been recognized in most discussions of the stimulus.

The first point is explained in detail in an earlier analysis.1 This paper explains the second point.

How Much of the Spending in the Stimulus Bill Is Actually Stimulative?

The total size of the American Recovery and Reinvestment Act of 2009 (ARRA) was $787 billion. This is approximately equal to 2.6 percent of GDP over the years 2009-2010. However, not all of this money will provide a boost to the economy in calendar years 2009-2010.

Approximately $70 billion of this appropriation was for a one-year patch of the Alternative Minimum Tax (AMT). While this patch provides a stimulus compared to a situation in which the AMT is not patched, Congress has always moved to adjust the AMT in this manner. There was probably no one in the country who had actually expected to pay the taxes that would have been required in the absence of an AMT fix, so this patch does not realistically provide any boost to the economy.

Furthermore, some of the spending in the bill continues beyond 2010. For example, the money appropriated for modernizing the electrical grid and computerizing medical records will be spent out over the next decade. These may be very useful expenditures, but money spent in 2015 will not boost the economy in 2009 or 2010.

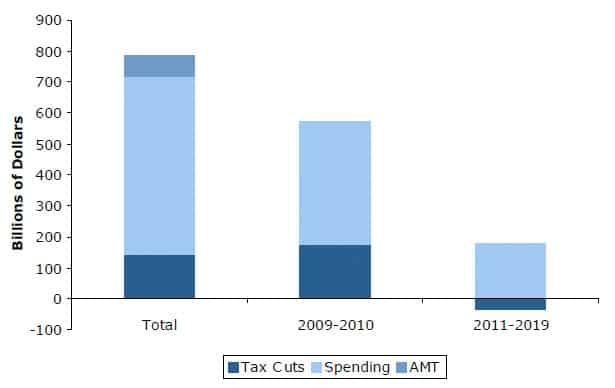

If the $787 billion ARRA appropriation is adjusted by excluding the $70 billion AMT patch and the spending of $146 billion that takes place in years after the end of calendar year 2010, the two-year total stimulus in the package falls to $571 billion, approximately 1.9 percent of GDP. This adjustment is shown in Figure 1.2

FIGURE 1: American Recovery and Reinvestment Act

Source: Congressional Budget Office and authors’ calculation, see Appendix.

Note: The negative tax cuts shown for years 2011-2019 translate into a net tax increase for these years.

The Impact of State and Local Cutbacks

In addition to the stimulus from the federal government, the actions of state and local governments will also impact the economy. The vast majority of these governments are facing budget deficits in 2009 and 2010 due to the economic downturn. Virtually all of these governments are required by their constitutions or charters to balance their budgets. Therefore, the projected deficits will force them to either cut spending and/or raise taxes. These spending cuts and tax increases will partially offset the impact of the stimulus. According to the Center for Budget and Policy Priorities, the shortfall for state governments in each of these years from 2009 through 2011 is projected to be more than $100 billion a year.3

In some cases, the money appropriated in the ARRA will be directly used to offset budget shortfalls, but this will not change the basic situation. If state and local governments have shortfalls of $100 billion filled by money from the ARRA, and therefore do not change their tax and spending policy, then the money from the ARRA has prevented contractionary spending cuts and/or tax increases, but this $100 billion will have provided no net stimulus to the economy. This is essentially what will happen to the $140 billion in ARRA funds directed towards state government shortfalls. The money will help to reduce contractionary spending, but as state government revenues decrease and projected shortfalls increase, the $140 billion will be insufficient to fill the entire gap of these government shortfalls.

In addition to the shortfalls projected for state governments, local governments are also projected to face shortfalls. An examination of 20 cities found an average projected shortfall of 3 percent of their total budget. In order to avoid double-counting (approximately half of local revenues are attributable to state governments), we have assumed that local governments will have to cut spending and/or raise taxes by an amount equal to 3 percent of locally-generated tax revenue. This adds $15 billion to the projected state and local government shortfalls for 2009 and 2010.

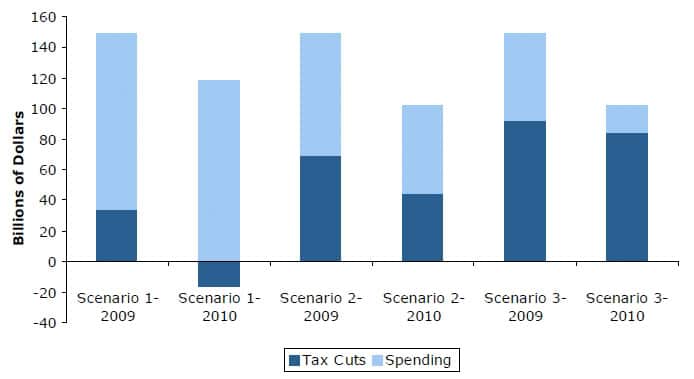

The total stimulus package for combined calendar years 2009 and 2010 is $571 billion, which was calculated in Figure 1. Taking state and local budget shortfalls into account, the stimulus package for this period is further reduced. The net government stimulus from the ARRA for 2009 and 2010 is shown in Figure 2. Since the exact mix of spending cuts and tax increases that these state and local governments will pursue is not yet known, three possible scenarios are calculated in the figure below. The first scenario assumes that state and local governments make up their shortfalls with equal amounts of spending cuts and tax increases. Under the assumption that it is generally easier politically to cut spending than raise taxes, the second scenario assumes that 80 percent of the shortfall is met by spending cuts and just 20 percent is met by tax increases. The last scenario shows all of the shortfall being made up by spending cuts.

FIGURE 2: American Recovery and Reinvestment Act, Net Stimulus

Source: Congressional Budget Office and authors’ calculation, see Appendix.

Notes: Scenario 1 assumes states will make up their budget shortfalls with equal parts spending cuts and tax increases, Scenario 2 assumes 80% spending cuts and 20% tax increases, Scenario 3 assumes 100% spending cuts. The tax cuts are negative in the 2010 Scenario 1 bar as a result of larger assumed increases in state taxes relative to the federal tax cuts from ARRA.

After netting out the spending cuts and tax increases at the state and local level, the government stimulus for 2009 and 2010 averages just $126 billion a year, or less than 0.9 percent of GDP. Perhaps even more seriously, if state and local governments rely primarily on spending cuts rather than tax increases to make up their shortfalls, then they will even further offset the stimulus of the ARRA because on a dollar per dollar basis, tax cuts have considerably less impact than spending increases.4

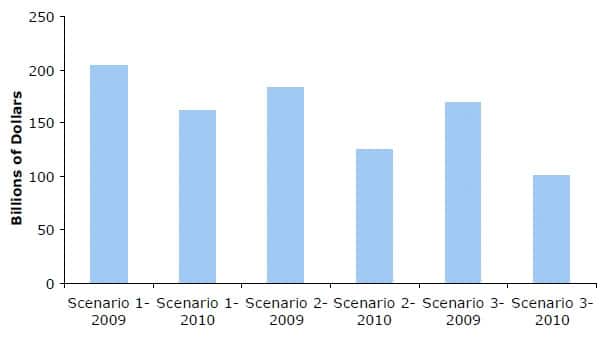

Figure 3 shows the implied net impact on GDP of the ARRA coupled with state and local spending cuts and tax increases in each of the three scenarios described above. The projections assume that the multiplier for government spending at all levels of government averages 1.5, while the multiplier for tax cuts is 0.9. As can be seen, the net impact of government actions in 2009 and 2010 is quite limited.

FIGURE 3: American Recovery and Reinvestment Act, Net Economic Impact

Source: Congressional Budget Office and authors’ calculation, see Appendix.

Notes: Scenario 1 assumes states will make up their budget shortfalls with equal parts spending cuts and tax increases, Scenario 2 assumes 80% spending cuts and 20% tax increases, Scenario 3 assumes 100% spending cuts.

In the first scenario, the net impact raises GDP by $204 billion in 2009, or 1.4 percent. In 2010 the projected increase is $162 billion, less than 1.1 percent of GDP. (These calculations assume that the full multiplier impact is felt immediately. In reality, the multiplier effect would take place over a period of time.) The impact is smaller in scenarios 2 and 3. In the last scenario the net impact is $169 billion in 2009, approximately 1.1 percent of GDP, and $101 billion, or 0.7 percent of GDP, in 2010.

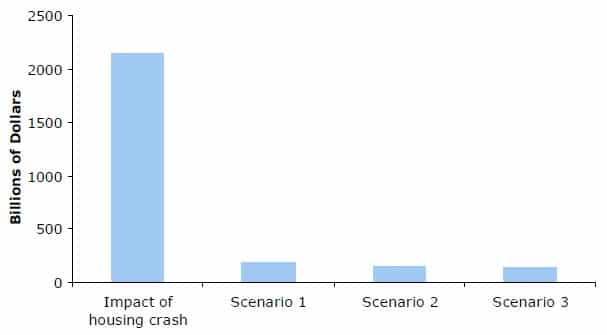

The effect of this stimulus is dwarfed by the shortfall in demand resulting from the collapse of the housing bubble. The collapse of the housing bubble will push residential construction in 2009 and 2010 down by 1.5 percentage points of GDP compared with its 2007 level, the last pre-recession year. Non-residential construction is also likely to fall by an amount at least equal to 1 percentage point of GDP compared with its 2007 level, as the sector adjusts to overbuilding. This drop would return the non-residential construction sector to the same share it had in 2002 following the end of dot.com boom.

The savings rate has already risen from close to zero to almost 5 percent of disposable income. With the housing wealth created by the bubble now evaporated, it is likely that saving will rise back towards its post-World War II average of 8 percent of disposable income. This shift implies a fall in consumption equal to approximately 7 percent of GDP.5

The multiplier on each of these sources of lost demand would be approximately 1.5, the same as for government spending. Figure 4 shows the GDP loss from the collapse of the bubble together with the net boost provided by government actions in each of the three scenarios described above. The effects for 2009 and 2010 are averaged for simplicity.

FIGURE 4: Impact of the Housing Crash and the Net Government Response

Source: Authors’ calculation, see Appendix.

Notes: Scenario 1 assumes states will make up their budget shortfalls with equal parts spending cuts and tax increases, Scenario 2 assumes 80% spending cuts and 20% tax increases, Scenario 3 assumes 100% spending cuts.

As can be seen, the housing crash is projected to lead to a reduction in annual demand of more than $2.1 trillion. This is more than ten times as large as the $183 billion average annual net economic boost generated by the ARRA in the first scenario. The falloff in demand is more than 15 times as large as the net average annual stimulus implied by the ARRA in the third scenario.

Conclusion

This paper has examined the net stimulus resulting from the ARRA coupled with the spending cutbacks and tax increases that can be assumed at the state and local level as a result of projected budget shortfalls. The response of state and local governments will offset much of the $571 billion stimulus in ARRA for 2009 and 2010, leaving an average of $126 billion a year of government stimulus, less than 0.9 percent of GDP after spending cuts and tax increases are taken into account. As a result of all of this, the net impact of government actions on the economy will be limited and will be a full magnitude of order smaller than the size of the $2.1 trillion demand shortfall created by the collapse of the housing bubble. The falloff in demand could be as much as 15 times the net average annual stimulus implied by ARRA and could leave the U.S. with a net impact as low as 1.1 to 0.7 percent of GDP for 2009 and 2010 respectively.

These simple calculations should help to put some perspective on the likely impact of the ARRA. They suggest that Congress may want to consider another round of stimulus to counteract the housing crash.

Appendix

Figure 1 — The first bar in Figure 1 combines the total tax cuts, the one-year Alternative Minimum Tax, and spending in the ARRA as described in CBO, 2009.

The second bar excludes the portion of the tax cut attributable to the one-year adjustment of the Alternative Minimum Tax and also excludes spending and tax cuts projected to occur in years after 2010. To adjust fiscal year data to get calendar years, it was assumed that spending and tax cuts for calendar 2009 were equal to the projections for fiscal 2009 plus 25 percent of the projections for fiscal 2010. For calendar 2010, we multiplied spending from the first three quarters of calendar 2010 by 133 percent to get full year spending, effectively assuming that the government continues to spend at the same rate in the fourth quarter of 2010 as it did in the first three quarters of the year. Since there were no substantial tax cuts projected for years after 2010, it was assumed that the tax cuts for calendar 2010 were equal to the 75 percent of the tax cuts projected for fiscal 2010 plus 25 percent of the projections for 2011.

The third bar shows the amount of spending and tax cuts projected for calendar years 2011 through the end of ARRA in 2019. The total amount of spending was equal to the projected spending from fiscal 2012 and beyond as well as the amount projected for fiscal 2011 minus 25 percent of the spending projection for calendar 2010, since this amount was already counted in the 2010 calendar year. The tax cuts for calendar years 2011 through 2019 were equal to 75 percent of the tax cuts for fiscal 2011 plus the remaining tax increases through fiscal years 2019.

Figure 2 — The two bars in Scenario 1 adjust the annual spending and tax cuts from the ARRA as calculated above for the state and local spending cuts and tax increases under the assumption that half of the projected budget shortfalls would be met by spending cuts and half would be met by tax increases. The bars in Scenario 2 assume that 80 percent of the projected shortfall will be met with spending cuts and 20 percent by tax increases. The bars in Scenario 3 assume that all of the shortfall will be met with spending cuts.

The projections of state shortfalls were taken from CBPP, 2009. To adjust the fiscal years to calendar years it was assumed that the 2009 shortfall was equal to 50 percent of the shortfall projected for 2009 and 50 percent of the shortfall projected for 2010. The shortfall projected for 2010 is assumed to be equal to 50 percent of the shortfall for 2010 and 50 percent of the shortfall projected for 2011. The projections for local government shortfalls were taken from a random analysis of 20 cities (list and sources available upon request), which found an average budget shortfall for 2009 and 2010 equal to approximately 3 percent of projected spending. To avoid double-counting of shortfalls, this number was only applied to the portion of local government revenue directly raised from the public (approximately $500 billion annually, U.S. Bureau of Economic Analysis, National Income and Product Accounts, Table 3.21, line 2), not to grants from the state or federal government.

Figure 3 — Figure 3 projects the net stimulatory effect of the changes in government spending at all levels in 2009 and 2010 under the assumption that spending has a multiplier of 1.5 and tax cuts have a multiplier 0.9.

Figure 4 — The first bar in Figure 4 shows the projected contractionary impact of the housing crash under the assumption that residential construction declines by an amount equal to 1.5 percentage points of GDP, non-residential construction falls by an amount equal to 1.0 percentage point of GDP, and consumption falls by an amount equal to 7.0 percentage points of GDP. A multiplier of 1.5 is applied to these assumed declines in spending. The boost to GDP in each of the three scenarios is the average for 2009 and 2010 shown in Figure 3.

1 Baker, Dean. 2009. “The Housing Crash Recession and the Case for a Third Stimulus.” Center for Economic and Policy Research.

2 The breakdown for the timing of the spending and tax cuts is taken from Congressional Budget Office, 2009. “Estimated Macroeconomic Impacts of the American Recovery and Reinvestment Act of 2009: Letter to the Honorable Charles F. Grassley,” Washington, D.C.: Congressional Budget Office.

3 These projections are taken from tables 2 and 3 of Lav, I. and E. McNichol, 2009. “State Budget Troubles Worsen,” Washington, D.C.: Center for Budget and Policy Priorities.

4 The multipliers for tax cuts and spending increases are discussed in the Congressional Budget Office’s analysis of the economic impact of the ARRA. See footnote 1.

5 Disposable income is equal to approximately 73 percent of GDP. It is also important to adjust for the statistical discrepancy (the difference between the output side measure and the income side measure) in the GDP accounts. This had turned negative in the years 2005-2007, most likely because capital gains in the stock market were showing up as income (it also had been negative in the late 90s). More typically it is positive by an amount approximately equal to 1 percent of GDP. It is generally believed that the output side measure is more accurate than the income side measure. Since saving is measured as income minus consumption, if income is overstated (as would be implied by the negative statistical discrepancy) then saving would also be overstated. If an output side measure of income is used, then saving was negative at the peak of the bubble and the decline in consumption needed to adjust to more normal levels will be even larger.

Dean Baker is an economist and Co-Director of the Center for Economic and Policy Research (CEPR) in Washington, D.C. Rivka Deutsch is a research intern at the Center for Economic and Policy Research. We would like to thank Shawn Fremstad for helpful comments on this paper. This report was first published by the CEPR in May 2009. Download the report in PDF at <cepr.net/documents/publications/stimulus-2009-05.pdf>.