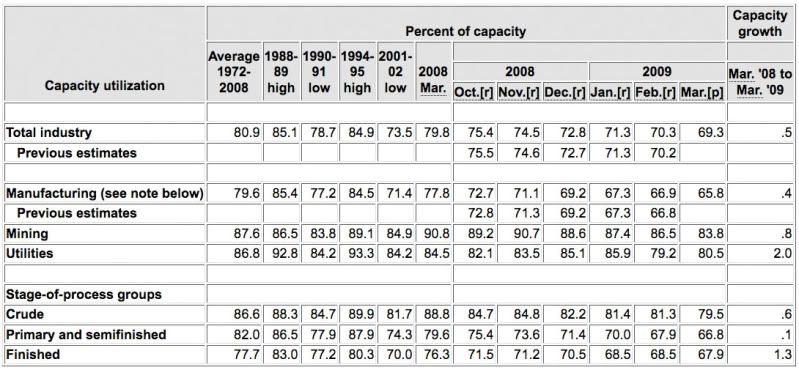

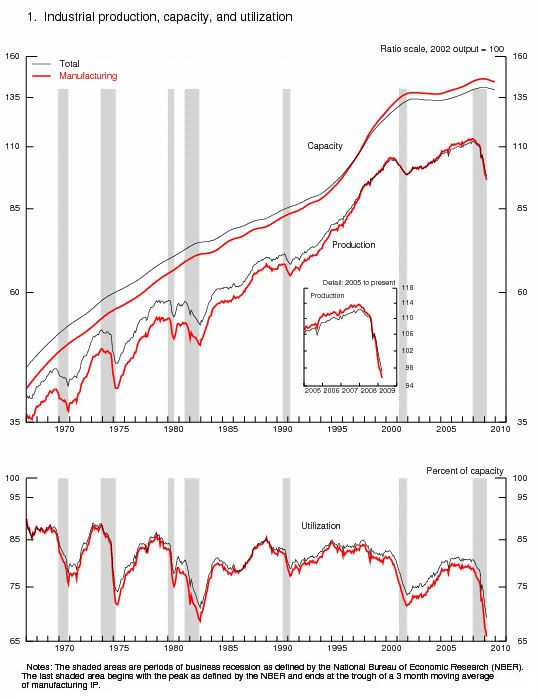

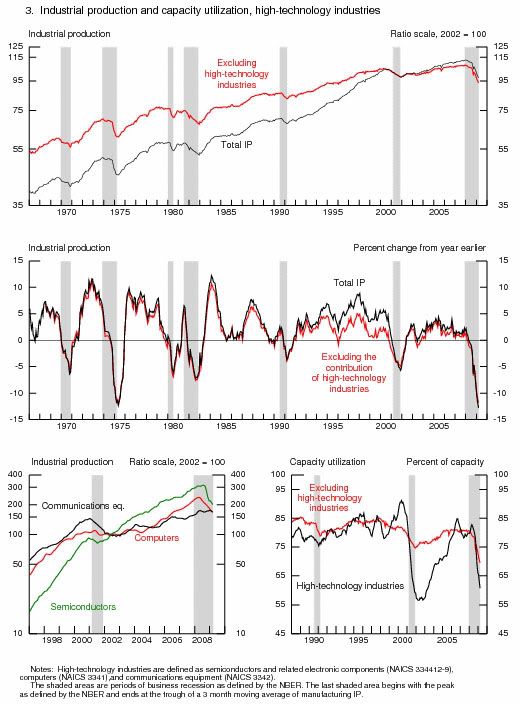

Industrial production fell 1.5 percent in March after a similar decrease in February. For the first quarter as a whole, output dropped at an annual rate of 20.0 percent, the largest quarterly decrease of the current contraction. At 97.4 percent of its 2002 average, output in March fell to its lowest level since December 1998 and was nearly 13 percent below its year-earlier level. Production in manufacturing moved down 1.7 percent in March and has registered five consecutive quarterly decreases. Broad-based declines in production continued; one exception was the output of motor vehicles and parts, which advanced slightly in March but remained well below its year-earlier level. Outside of manufacturing, the output of mines fell 3.2 percent in March, as oil and gas well drilling continued to drop. After a relatively mild February, a return to more seasonal temperatures pushed up the output of utilities. The capacity utilization rate for total industry fell further to 69.3 percent, a historical low for this series, which begins in 1967.

INDUSTRIAL PRODUCTION AND CAPACITY UTILIZATION: SUMMARY

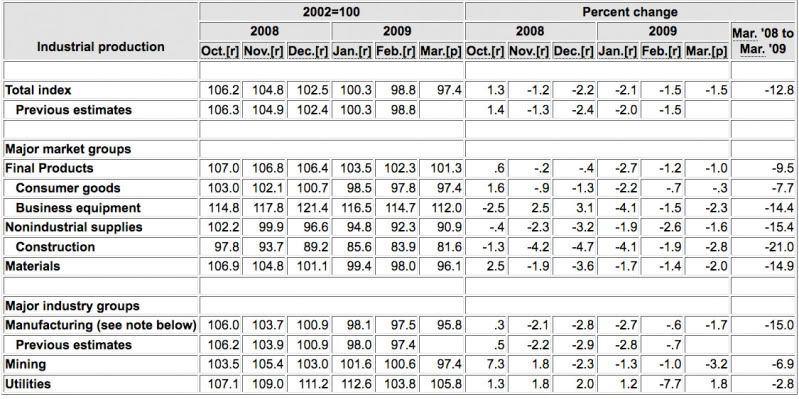

Seasonally adjusted

Market Groups

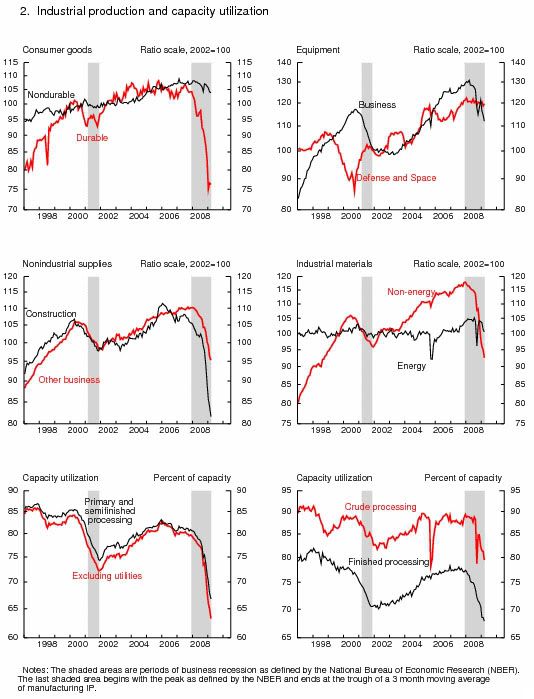

Most major market groups recorded decreases both for March and for the first quarter as a whole. The production of consumer goods declined 0.3 percent in March and dropped at an annual rate of nearly 15 percent in the first quarter. Consumer durables declined 0.5 percent in March, as a gain of nearly 2 percent in the output of automotive products partially offset declines in home electronics; appliances, furniture, and carpeting; and miscellaneous goods. Despite the recent increase in automotive-related production, motor vehicle assemblies in March, at an annual rate of 5.0 million units, were more than 4 million units below the level 12 months earlier. The production of nondurable goods edged down 0.3 percent in March, as declines in foods and tobacco, chemical products, and paper products offset gains in clothing and energy.

The output of business equipment decreased 2.3 percent in March, as production in all of its major categories moved down. For the first quarter as a whole, business equipment fell at an annual rate of 11.7 percent. The production of transit equipment increased at an annual rate of 70 percent in the first quarter; this advance was more than accounted for by a gain in civilian aircraft after a strike that affected output in the fourth quarter. Elsewhere in business equipment, the output indexes for information processing equipment and for industrial and other equipment fell.

The output of defense and space equipment dropped at an annual rate of 1.8 percent in the first quarter despite a gain of nearly 1 percent in March. Overall, production in this sector has been little changed, on net, since the third quarter of 2007.

The output of construction supplies decreased 2.8 percent in March. Production of these goods dropped at an annual rate of nearly 36 percent in the first quarter after falling a bit more than 26 percent in the fourth quarter of 2008. This index is now about 27 percent below its peak in January 2006. Widespread declines pulled down the output of business supplies 1.1 percent in March.

The production of materials to be further processed in the industrial sector continued to exhibit broad-based declines. Materials output decreased 2.0 percent in March, and for the first quarter, output fell at an annual rate of 22.4 percent after dropping more than 16 percent in the fourth quarter. All major components of durable and nondurable materials posted steep declines in March, and the production of energy materials slipped 0.7 percent.

Industry Groups

| See, also, Mary Williams Walsh and Jonathan Glater, “Contracts Now Seen as Being Rewritable” (New York Times, 30 March 2009); Erik Eckholm, “States Slashing Social Programs for Vulnerable” (New York Times, 11 April 2009); and Robert Pear, “State Cuts Delay U.S. Benefits, Official Says” (New York Times, 12 April 2009).

And here’s the “Kick Me” sign slapped on the back of the US working class:

|

In March, manufacturing output decreased 1.7 percent, and, for the first quarter as a whole, manufacturing output dropped at an annual rate of 22.5 percent after falling nearly 18 percent in the fourth quarter. The factory operating rate, which extends back to 1948, dropped 1.1 percentage points to a new historical low of 65.8 percent. The production index for durable goods fell 2.4 percent in March and contracted at an annual rate of more than 30 percent for the first quarter. The only major component of durable manufactures to increase production for the month was motor vehicles and parts; nonetheless, output in this industry fell at an annual rate of about 67 percent for the quarter as a whole. The production of nondurable goods decreased 1.0 percent in March as a result of substantial declines in textile and product mills, paper products, and plastics and rubber products. Production for nondurable goods fell about 13 percent in the first quarter and has fallen for six consecutive quarters.

The index for the other manufacturing category, which consists of publishing and logging, fell nearly 3 percent in March.

The output of electric and natural gas utilities moved up 1.8 percent in March, as production rebounded after temperatures returned to more seasonal norms. The operating rate for utilities moved up 1.3 percentage points, to 80.5 percent, yet remained below its 1972-2008 average. Mining output dropped 3.2 percent in March, and the utilization rate fell to 83.8 percent, roughly 4 percentage points below its 1972-2008 average. For the first quarter, the output of mines fell nearly 15 percent at an annual rate.

Capacity utilization rates in March at industries grouped by stage of process were as follows: At the crude stage, utilization dropped 1.8 percentage points, to 79.5 percent, a rate 7.1 percentage points below its 1972-2008 average; at the primary and semifinished stages, utilization dropped 1.1 percentage points, to 66.8 percent, a rate 15.2 percentage points below its long-run average; and at the finished stage, utilization slipped 0.6 percentage point, to 67.9 percent, a rate 9.8 percentage points below its long-run average.

Revision of Industrial Production and Capacity Utilization

The Federal Reserve Board released its annual revision to the index of industrial production (IP) and the related measures of capacity utilization on March 27, 2009. The revised IP indexes incorporated data from selected editions of the U.S. Census Bureau’s 2007 Current Industrial Reports. Detailed data from the 2007 Economic Census, however, were not available. Annual data from the U.S. Geological Survey regarding metallic and nonmetallic minerals (except fuels) for 2007 were incorporated. Utilization rates were updated to incorporate data from the U.S. Census Bureau’s Quarterly Survey of Plant Capacity through 2008 as well as data from other government and trade sources.

The published revision release is available on the Board’s website at www.federalreserve.gov/releases/G17. The revised data are also available through the website of the Department of Commerce. Further information on the revision can be obtained from the Board’s Industrial Output Section (telephone number 202-452-3197).

Note. The statistics in this release cover output, capacity, and capacity utilization in the U.S. industrial sector, which is defined by the Federal Reserve to comprise manufacturing, mining, and electric and gas utilities. Mining is defined as all industries in sector 21 of the North American Industry Classification System (NAICS); electric and gas utilities are those in NAICS sectors 2211 and 2212. Manufacturing comprises NAICS manufacturing industries (sector 31-33) plus the logging industry and the newspaper, periodical, book, and directory publishing industries. Logging and publishing are classified elsewhere in NAICS (under agriculture and information respectively), but historically they were considered to be manufacturing and were included in the industrial sector under the Standard Industrial Classification (SIC) system. In December 2002 the Federal Reserve reclassified all its industrial output data from the SIC system to NAICS.