Countless academics have sought to measure the tangible benefits of being a union member. The difference between union and non-union wages, often referred to as the “union premium,” can be calculated in many different ways. It’s a profoundly complex field. . . . Here’s a classic example of the poop one has to wade through in search of enlightenment:

If heteroscedasticity is present and affects the coefficient estimates, the quantile regression estimation suggests that the rate of change of the unobservables is different at different quantiles for males but it is not the case for females.

Right-ho, then.

Strangely, international data on the union premium has never, to our knowledge, been assembled in an easily accessible form. The most that we found was a list of 19 countries. No doubt there are good reasons for this, probably involving heteroscedasticity. Anyway, let’s start with a sample of five countries and then consider some of the issues.

| Country | Premium | Year |

| Canada | 7.7% | 2002 |

| Japan | 8% | 2003 |

| Turkey | >100% | 2001 |

| United Kingdom | 17.1% | 2004 |

| United States | 20% | 2003 |

(Note: these figures are not necessarily comparable, as different methodologies and definitions may have been used).

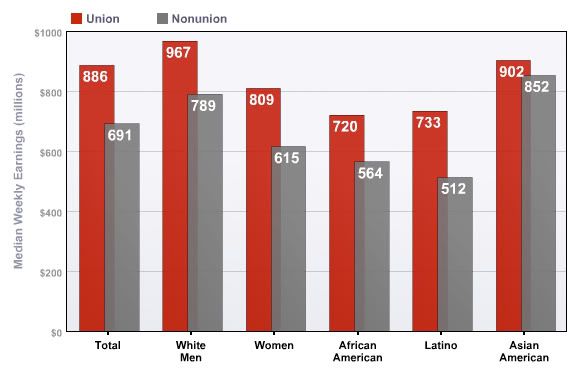

And here’s some more recent data from the U.S. prepared by the AFL-CIO:

Median Weekly Earnings of Full-Time Wage and Salary Workers, 2008

Source: U.S. Department of Labor, Bureau of Labor Statistics, “Union Members in 2008,” January 2009. Prepared by the AFL-CIO.

Before we go any further, though, let’s stop and ask ourselves if a high union premium is necessarily a good thing for workers. At first this may seem an odd question, but as the Canadian Labour Congress has pointed out:

The union wage premium has been found to be lowest in countries where union density is high, and highest where union density is low. Thus it is much higher in the US than in Sweden. This is surprising on the surface, but it reflects the fact that non-union employers will be more likely to be forced to match union wages where unions are very strong. . . . The goal is to improve the working conditions of all workers rather than raising the wages of a union elite. A very high union wage premium and low union density is likely to promote strong employer resistance to unions, as in the US. On the other hand, widespread unionization, as in Sweden, is likely to promote much less strong employer opposition, at least once high density has been established. That is because, in highly unionized environments, wages are effectively ‘taken out of competition’. . . . Employers must then compete with each other on the basis of non-wage costs, productivity and quality.

Employers would do well to reflect on this. Does it really make sense to pay workers extra so that they won’t unionize, on the basis that the company can then compete on wage costs? Reducing the union premium in this way is common practice in many developed countries, but savings are seldom compared against the costs of employee alienation, angry organizing campaigns, anti-union consultants, ongoing legal costs, and the commercial risk of a public relations meltdown.

Sadly, the majority of countries do allow businesses to compete on wages. Such competition leads to an endless pressure on wages, and of course workers have no choice but to resist. By and large, as we can see above, this resistance pays off well.

Unions in other countries, such as Australia, Austria, Brazil, Canada, Chile, Cyprus, Denmark, Japan, New Zealand, Norway, Portugal and Spain, are also able to raise wages by significant amounts.1

In Germany “. . . works councils are associated with higher earnings. The wage premium is around 11 percent (and is higher under collective bargaining).”

In South Africa “. . . We estimate union premia on the order of 20 percent for African workers and 10 percent for white workers.”

In the U.S. “The standard estimate of the average union premium (union vs. non-union wage gap) of 15% might be incorrect due to two forms of measurement that create an error bias in the data. . . . These procedural errors lead to a downward bias, indicating that the average union premium could be as high as 24%.”2

An interesting result of this battle is that a unionized workforce also tend to reshape the economic landscape as they struggle over wages.

“An almost universal finding is that union/non-union wage differentials are larger for lower-skilled than for higher-skilled workers.”

In the U.S.

When one compares workers whose experience, education, region, industry, occupation and marital status are comparable, those covered by a union agreement (are also):

- 28.2% more likely to have employer-provided health insurance

- 53.9% more likely to have pension coverage

- 14.3% more paid time off.

The union wage premium varies by race, ethnicity and gender, but is large for every group:

- Whites – 13.1%

- Blacks – 20.3%

- Hispanics – 21.9%

- Asians – 16.7%

. . . Unions also lessen inequality because they are more successful at raising the wages of those in the bottom 60% of the wage pool.3

By now you’re getting the picture . . . and it’s complicated stuff. Unions are good for working people, as a whole, but the financial benefits of unionism do not simply bounce back to the sole benefit of those who pay the fees.

Various studies have shown that unions tend to make pay fairer (ie across society), rather than just higher (ie for members only). But do fee-paying members get a good return on their investment? Sadly we can’t prove this. The necessary data just isn’t available. In fact the move towards private employment contracts and fluid working arrangements means we may never again see proper comparative figures. The best we can do for you is to break our own rule, and include data from the 1990s.

| Country | Premium | Year(s) |

| Australia | 12% | 1994, 8, 9 |

| Austria | 15% | 1994, 5, 8, 9 |

| Brazil | 34% | 1999 |

| Canada | 8% | 1997-9 |

| Chile | 16% | 1998-9 |

| Cyprus | 14% | 1996-8 |

| Denmark | 16% | 1997-8 |

| France | 3% | 1996-8 |

| Germany | 4% | 1994-9 |

| Italy | 0% | 1994 & 8 |

| Japan | 26% | 1994-6, 8, 9 |

| Netherlands | 0% | 1994 & 5 |

| New Zealand | 10% | 1994-9 |

| Norway | 7% | 1994-9 |

| Portugal | 18% | 1998-9 |

| South Africa | 20% | 2006 |

| Spain | 7% | 1995, 7-9 |

| Sweden | 0% | 1994-9 |

| United Kingdom | 10% | 1993-2002 |

| United States | 17% | 1973-2002 |

Unless otherwise stated (see below), this data comes from “The Effect of Trade Unions on Wages” by Alex Bryson, Reflets et Perspectives de la Vie Economique, 2007. This article can be purchased for 5 Euro here.

When looking at the figures for Italy, the Netherlands, and Sweden, don’t assume that the unions there aren’t doing their jobs! As Bryson points out: “this is primarily due to the fact that unions are also able to control wage outcomes in the non-union sector.” The same holds true, to a lesser extent, for France and Germany. Although our figures are dated, it looks pretty clear that being a union member pays off. In fact when one compares union fees against wage/salary gains, there would be very few investments in the world which pay such handsome dividends.

And yet this financial incentive is clearly not the sole reason people join/fail to join. Why are there so few members in the US, where the rewards are so high? And why would a worker in Italy, the Netherlands, or Sweden join? There seems to be no simple link between union density and the union wage premium. None at all. Yes, union membership pays a high dividend to members. But it also generates benefits for others, some of whom are not members.

It seems that the cost-benefit ratio of unionism cannot be calculated in any normal way. Investing in values. Solidarity. Social justice. This is the kind of maths that modern economists simply can’t figure. It’s a pity, because there seems to be an awful lot of it going around.

To download a list of further readings on this subject, click here.

1 David Blanchflower and Alex Bryson, “Changes over Time in Union Relative Wage Effects in the UK and the US Revisited,” December 2002.

2 Barry T. Hirsch, “Reconsidering Union Wage Effects: Surveying New Evidence on an Old Topic,” Journal of Labor Research, Spring 2004.

3 Lawrence Mishel, President of the Economic Policy Institute, Testimony before the U.S. Senate Committee on Health, Education, Labor, and Pensions, March 2007.

This article was made available on the Web site of the New Unionism Network. It is edited and reproduced here for educational purposes.