The International Monetary Fund (IMF) has published its latest projections for economic growth around the world.1 At first glance, the IMF projections for Latin America seem unlikely. The IMF has a lengthy record of biased projections of growth in the region2 and has been consistently underestimating growth in countries such as Argentina and Venezuela, which have spurned IMF advice.3

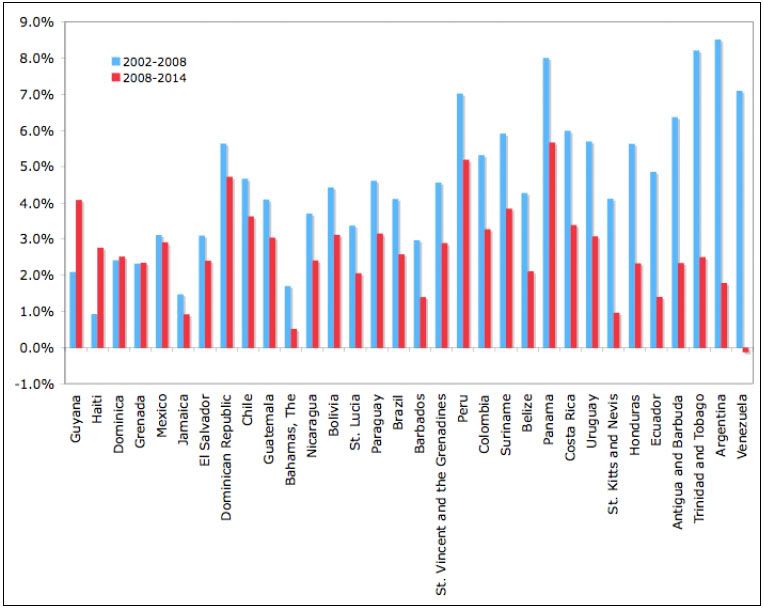

Figure 1 shows the projected average annual growth for the countries of the Western Hemisphere (less the United States and Canada) over the six years 2008-2014 along with the historical growth in each county’s real GDP over the previous six years 2002-2008.

The countries are ordered by the changes in their growth rate from Guyana, with a growth rate that is predicted to nearly double from 2.1 percent to 4.1 percent, to Venezuela, which had grown an average of 7.1 percent per year from 2002-08, but is projected to lose 0.1 percent per year through 2014.

FIGURE 1: Growth in 2002-08 and IMF Projections 2008-14

Source: IMF World Economic Outlook, April 2009.

Haiti

There are many odd-looking projections in this list. Haiti, at 0.9 percent per year, experienced the slowest growth of any country in the region since 2002. The IMF is projecting Haiti to grow an average of 2.8 percent per year for the next six years, placing it squarely in the middle of the region. However, since 1980, Haiti has never averaged growth of even two percent per year for six years — except for the 1994-2000 period following the disastrous military rule of 1991-94. Even after those six years of growth, by 2000 the Haitian economy was only 2.2 percent larger than it had been in 1991. If Haiti were to grow nearly three percent per year between 2008 and 2014, this would be an extraordinary departure from past trends

Mexico and Venezuela

Mexico and Venezuela serve as startling contrasts. As an open economy exporting about 21 percent of its GDP to the United States, and receiving 2.3 percent of GDP in remittances,4 we might expect Mexico to be hit hard by the U.S. recession.5 The IMF projects Mexico to suffer a significant decline in 2009, shrinking by 3.7 percent — second only to The Bahamas. The next largest decline projected for 2009 among large countries is Venezuela — another oil-producer with exports to the United States. It is projected to shrink by 2.2 percent this year. However, Mexico is expected to make a quick recovery. Over the next six years, the IMF projects that Mexico will grow at a rate of 2.9 percent per year — hardly a dent in the 2002-08 growth rate of 3.1 percent. By contrast, Venezuela, which has grown by an average of 7.1 percent per year since 2002,6 is projected to fail to recover by 2014. According to the IMF, the Venezuelan economy will be 0.7 percent smaller six years later than it was in 2008. The IMF’s World Economic Outlook (WEO) appears to attribute this difference to the increased “cost of financing” relative to “other countries with better initial positions and larger policy buffers, including . . . Mexico.” This projection that Venezuela’s economy will actually shrink over the next six years, appears to be highly improbable.

Along with Argentina and Panama, Venezuela has been one of the fastest growing economies in the Western Hemisphere over the last six years, yet it is the only country in the region which the IMF anticipates will not recover by 2014. Venezuela had run large current account surpluses in the previous years and has large financial reserves from which to draw upon if needed. The WEO projects that the average price of oil will be “$52.00 in 2009 and $62.50 a barrel in 2010, and will remain unchanged in real terms over the medium term” and after 2009 projects large and increasing current account surpluses for Venezuela — reaching 8.4 percent of GDP in 2014.7 Venezuela has recently concluded a $12 billion investment agreement with China, in which China is putting up two-thirds of the funds, and has other multi-billion dollar investment agreements with Russia and Iran. Venezuela’s total public debt is a relatively low 14.3 percent of GDP, with foreign debt amounting to only 9.8 percent of GDP. The country sits on what may be the largest oil reserves in the world. It is difficult to believe that they will not be able to borrow if necessary or attract foreign direct investment, including in the oil industry, over the next six years. Therefore, it is difficult to imagine the scale of the economic collapse that would be required to cause negative GDP growth over the next six years.

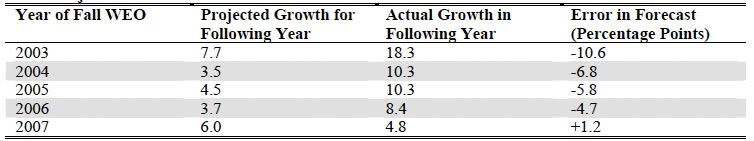

As can be seen in Table 1, the IMF has consistently underestimated Venezuela’s growth for several years.

TABLE 1: IMF Projected GDP Growth for Venezuela and Actual Growth

Source: IMF World Economic Outlook, 2003-2007 and author’s calculations

Though the IMF’s prediction for 2008 (made in October 2007) proved optimistic, this is due to the failure to anticipate the current recession, rather than a rosier view of the country. Just six months ago, despite the deepening U.S. recession, the IMF projected 3.2 percent economic growth in the Western Hemisphere overall in 2009, and now projects a fall of 1.5 percent.

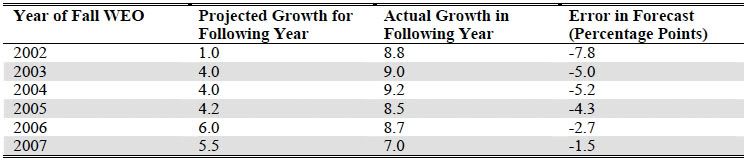

Argentina

The IMF’s forecasting record in Argentina is even worse than in Venezuela, as can be seen in Table 2. Since Argentina defied the IMF in late 2001, with a record sovereign debt default, a failure to reach agreement with the Fund, and the adoption of a number of economic policies that the IMF opposed, the Fund has regularly underestimated Argentina’s growth — sometimes by enormous margins.

TABLE 2: IMF Projected GDP Growth for Argentina and Actual Growth

Source: IMF World Economic Outlook, 2002-2007 and author’s calculations

Despite an average of 8.5 percent annual growth over the last six years, the IMF is projecting an average of only 1.8 percent annual growth for Argentina over the next six years — one of the lowest growth projections among the countries in the Western Hemisphere. Argentina’s external debt is 17 percent of GDP.8 Peru, which is much more dependent on commodity exports9 but with “larger policy buffers” has external debt of 14 percent and is anticipated to grow 5.2 percent per year through 2014.

It is difficult to explain the IMF’s forecasts for Venezuela and Argentina over the next six years, except as a continuation of a pattern of grossly underestimating these countries’ growth performances over the last six years.10

1 International Monetary Fund. (2009). “World Economic Outlook, April 2009: Crisis and Recovery.” Accessed online on April 27, 2009.

2 See Baker, Dean and David Rosnick. (2003). “Too Sunny in Latin America?: The IMF’s Overly Optimistic Growth Projections and Their Consequences.” Washington, DC: Center for Economic and Policy Research. Accessed online on April 27, 2009.

3 See Weisbrot, Mark and David Rosnick. (2007). “Political Forecasting? The IMF’s Flawed Growth Projections for Argentina and Venezuela.” Washington, DC: Center for Economic and Policy Research. Accessed online on April 27, 2009.

4 Banco de Mexico. Remesas Familiares. Mexico City, Mexico: Banco de Mexico. Accessed online on April 27, 2009.

5 See Weisbrot, Mark, John Schmitt and Luis Sandoval. (2008). “The Economic Impact of a U.S. Slowdown on the Americas.” Washington, DC: Center for Economic and Policy Research. Accessed online on April 27, 2009.

6 This six-year average rate of growth includes a decline of 7.8 percent from 2002 to 2003 and follows a 8.9 percent decline the previous year, both due to a crippling oil strike.

7 For more on oil prices and Venezuela’s current account, see Weisbrot, Mark, Luis Sandoval and Rebecca Ray. (2009). “The Chávez Administration at 10 Years: The Economy and Social Indicators.” Washington, DC: Center for Economic and Policy Research. Accessed online on April 27, 2009.

8 Excluding arrears. Including arrears, the external debt is 19 percent.

9 In Peru, commodities (fish, agriculture, minerals, oil) account for 75.5 percent of exports; in Argentina commodities (live animals, agriculture, minerals) total just 39 percent of exports. Minerals alone account for 59 percent of Peru’s exports. See Insituto Nacional de Estadistica y Censos (INDEC), “Argentine Foreign Trade Statistics” (Argentina: INDEC, February 6, 2009; accessed online on April 27, 2009); and Banco Central de Reserva del Peru, “Series Estadisticas: Exportaciones” (Peru: BCRP, accessed online on April 27, 2009).

10 The Fund also grossly overestimated Argentina’s projected growth in its forecasts during the three years 1999-2001, when the country was operating under IMF agreements. See Weisbrot, Mark and David Rosnick. (2007). “Political Forecasting? The IMF’s Flawed Growth Projections for Argentina and Venezuela.” Washington, DC: Center for Economic and Policy Research. Accessed online on April 27, 2009.

David Rosnick is an economist at the Center for Economic and Policy Research (CEPR) in Washington, DC. The author would like to thank Mark Weisbrot and Jose Cordero for helpful comments and Jake Johnston for research assistance. This article was first published by CEPR in April 2009; it is reproduced here for educational purposes. Click here to download the article in PDF.