The 4th quarter US GDP figures confirm that the economic downturn, in its domestic aspect, is taking the classic form of an investment-led decline.

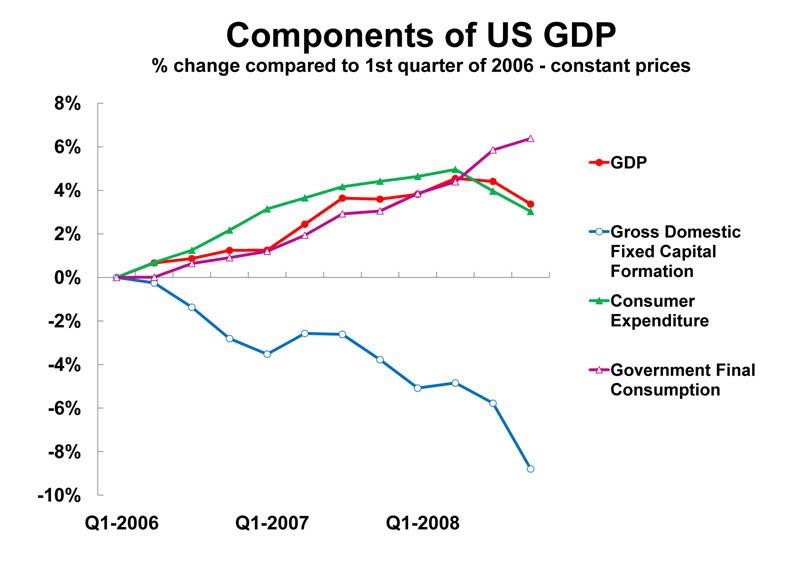

As seen in Figure 1 US fixed investment already started to fall from the 1st quarter of 2006 onwards — US consumer expenditure and GDP, in contrast, continued to rise until the 2nd quarter of 2008. Government consumption is still rising.

US GDP has so far declined by 1.1 per cent since its peak. Consumer expenditure has fallen by 1.8 per cent — also since its peak. However US fixed investment has already declined by 8.8 per cent since the first quarter of 2006.

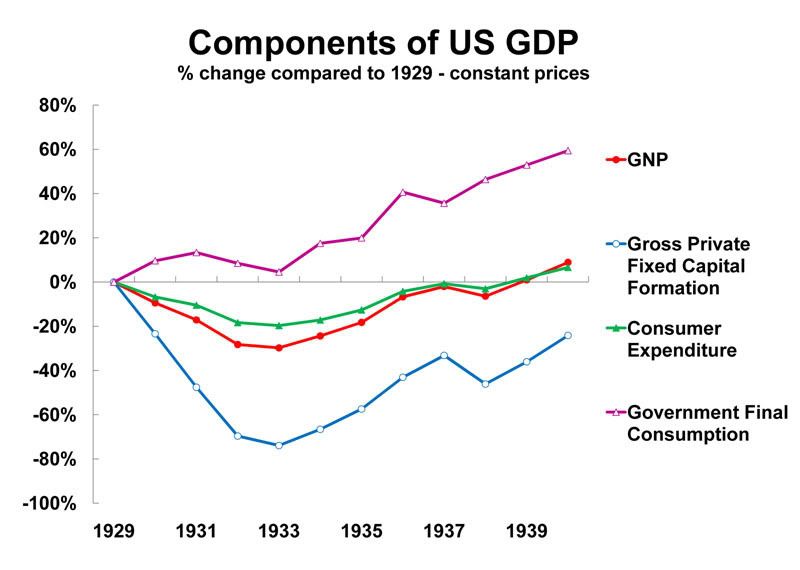

In order to illustrate the ‘classic’ form of the current downturn Figure 2 shows the decline in US GDP after 1929.

As may be seen the pattern of the current decline is almost identical to that after 1929 — with, of course, the dimensions of the latter case being much greater than those so far during this downturn.

US GNP (Gross National Product) fell by 29.7 per cent between 1929 and 1933. Personal consumption fell by 19.7 per cent in the same period. US government expenditure continued to rise throughout the depression. But US private domestic fixed investment fell by 73.9 per cent from its 1929 level.

Given the classic form of the present recession the decisive issue is therefore whether the decline in investment can be halted by indirect, Keynesian, means.

Keynes, as an explicit defender of the capitalist system, believed that a decline in investment, driving a recession, could be halted by indirect means — reduction in interest rates, government spending etc. It was not necessary for the state to directly control investment.

As Graham Turner has rightly and consistently stressed neither the US nor Britain is as yet applying real Keynesian methods. The most crucial issue in a Keynesian perspective is not primarily large budgetary deficits but driving down borrowing costs — in the present situation by central bank purchase of government debt. Governments are, agonisingly slowly, being forced to consider this through ‘quantitative easing’ — precisely direct central bank purchase of state debt.

But a further issue then arises. Will any indirect, Keynesian or other, method of halting the investment decline work? Because there is an alternative. This is the model which applies in China where a large state sector means that investment can be directly controlled.

This is coupled with a nationalised banking system in which financial institutions can be directly instructed to increase lending not simply to the state but to the private sector. China does not have to rely on indirect methods to attempt to persuade banks to expand credit — indirect methods which in the US and Britain have so far proved an almost complete failure compared to the rapid expansion of credit which is now taking place in China. But to employ these methods would require taking decisive sectors of the economy out of private ownership — that is proceeding from a Keynesian to a socialist solution.

This is now the decisive practical issue of economy management facing every country. In only three months the economics of neo-liberalism has theoretically and practically disintegrated under the impact of the worst financial crisis since 1929. There is not a single government in an advanced economy, one which enjoys some freedom of action, which is attempting to meet the present crisis by neo-liberal methods. Neo-liberalism is now confined to fringe monetarist fanatics and the British Conservative Party. All major governments are attempting to meet the economic downturn by what they essentially conceive of as Keynesian methods — and are, far too slowly, being gradually forced along a route from the running of crude budget deficits to more properly Keynesian ‘quantitative easing’.

The issue is whether any of these Keynesian methods will suffice. Or whether only a ‘Chinese’ style solution will work — that is state ownership of a sufficiently large sector of the economy to directly reverse the investment decline.

This will not be decided by economic theory but by how far and how deep the economic downturn goes. China will pursue its own path, which is more effective, but in the US, Europe and Japan if the downturn is ‘moderate’, which in current terms means the worst recession since World War II, then Keynesian methods may control it. If the downturn becomes worse than that then only ‘Chinese’ methods will suffice.

This article appeared in the Socialist Economic Bulletin, a bulletin published by Ken Livingstone, on 1 February 2009; it is reproduced here for educational purposes.