Abstract

Following the 2000-01 crisis, Turkey implemented an orthodox strategy of raising interest rates and maintaining an overvalued exchange rate. But, contrary to the traditional stabilization packages that aim to increase interest rates to constrain domestic demand, the new orthodoxy aimed at maintaining high interest rates to attract speculative foreign capital. The end result was shrinkage of the public sector, deteriorating education and health infrastructure, and failure to provide basic social services to the middle class and the poor. Furthermore, as the domestic industry intensified its import dependence, it was forced to adapt increasingly capital-intensive foreign technologies with adverse consequences on domestic employment. In the meantime, transnational companies and international finance institutions have become the real governors of the country, with implicit veto power over any economic and/or political decision that is likely to act against the interests of global capital.

Turkey experienced a severe economic and political crisis in November 2000, and again in February 2001. The crisis erupted as Turkey followed an exchange-rate based disinflation programme, led and engineered by the IMF.1 By 2001 the GDP had contracted by 7.4% in real terms, wholesale price inflation had soared to 61.6%, and the Turkish Lira had lost 51% of its value against the major foreign currencies. The burden of adjustment fell disproportionately on the labouring classes as the rate of unemployment rose steadily by 2 percentage points in 2001 and then by another 3 percentage points in 2002. Real wages fell abruptly by 20% upon impact in 2001, and had not recovered at the time this was being written.

The IMF has been involved with the macro management of the Turkish economy both before and after the crisis and provided financial assistance of $20.4 billion, net, between 1999 and 2003. Following the crisis, Turkey implemented the orthodox strategy of raising interest rates and maintaining an overvalued exchange rate. The government was forced to follow a contractionary fiscal policy. It also promised to satisfy the customary IMF demands: reduce subsidies to agriculture; privatize; and reduce the role of public sector in economic activity.

The post-crisis economic and political adjustments were overseen by the newly founded Justice and Development Party (AKP), which came to power in the November 2002 elections securing absolute majority in parliament. Though maintaining the pro-Islamic political agenda, the AKP nevertheless distanced itself from the previous “National View” orthodoxy of the traditional Turkish Islamic movement. The AKP refurbished itself with a more friendly view towards the West, ready to do business with global finance capital and willing to auction off strategic public assets to transnational companies. On the political arena, the AKP gave unequivocal support to US interests in the Middle East, including the then approaching war in Iraq.2

With a new Stand-By Arrangement on which the AKP government reached consensus with the IMF in 2005, the international financial institutions (IFIs) and the Turkish businesses were assured that the “reform” process would continue up to 2008, along the course set by the IMF’s structural adjustment programme in 1998. The programme was officially declared as a bundle of policies aimed at checking increases in both domestic and external debt and taking the country again to the path of “stable” growth. However, beyond what has been declared officially, the programme envisages much more radical arrangements in restructuring the political and social life as a whole. The primary and the most important target of these arrangements is to eradicate public services and related achievements in the fields of social security, education and health, and to commodify these services through privatization. A critical point to be underlined here is that all the governments of the recent period, including the AKP, have displayed their “most determined” political stand (and in turn were hailed as “credible” and “reputable“), completely ignoring the reactions coming from the people and the working classes. Seen from this angle, it will be safe to assert that Turkey constitutes one of the best examples of those societies where only formal aspects of political democracy are observed and nothing more (ISSA, 2006).

In fact, shortly after it took office, the AKP abandoned the discourse, manipulating anti-IMF and anti-liberal reactions in the country, and showed no hesitation in fully adopting neo-liberal policies, entrusting the national resources and economic future of the country directly to foreign capital and the non-fettered workings of the market. The distinguishing feature of the AKP government in this respect was that it undertook the mission of executing the neo-liberal project under the discourse of a “strong government”, without confronting any strong popular opposition (ISSA, 2006; Cizre and Yeldan, 2005). The AKP had acted faster and more boldly than any preceding government in implementing the neoliberal agenda, in an attempt to respond to the requests of international capital on the one hand, and to settle its problem of adaptation to the state and administrative traditions of the country, on the other.

The purpose of this paper is to portray the post-2001 crisis adjustments and the transformations in the Turkish political and economic arena under the auspices of the Bretton Woods Institutions (the IMF and the World Bank). It will focus on the macroeconomics of the AKP period, rather than the evolution of the 2001 crisis per se. The paper is organized under four sections. The first section is an overview of the Turkish macroeconomic adjustments with relevant economic evidence. The section focuses on the speculative nature of growth, with a detailed assessment of the modes of balance of payments financing under the AKP government. Section II examines the jobless growth patterns and documents data on the labour markets. The deterioration of the position of wage labour and its role in generating the necessary economic surplus under the post-crisis adjustments is documented in Section III. Section IV concludes the paper with a discussion of the political inferences of the neoliberal reforms of the post-crisis era.

I. Post-Crisis Characteristics of Growth

The current IMF programme in Turkey rests mainly on two pillars: (1) fiscal austerity that targets a 6.5 per cent surplus for the public sector in its primary budget3 as a ratio to the gross domestic product (GDP); and (2) a contractionary monetary policy (through an independent central bank) whose exclusive aim is price stability (via inflation targeting). Thus, in a nutshell, the Turkish government is charged with maintaining two targets: a primary surplus target in fiscal balances (at 6.5% of GDP); and an inflation-targeting central bank4 whose sole mandate is to maintain price stability and is divorced from all other concerns of macroeconomic aggregates.

According to the logic of the programme, the successful achievement of the fiscal and monetary targets would enhance “credibility” of the Turkish government, ensuring reduction in the country’s risk perception. This would enable reductions in the rate of interest that would then stimulate private consumption and fixed investments, paving the way for sustained growth. Thus, it is alleged that what is being implemented is actually an expansionary programme of fiscal contraction.

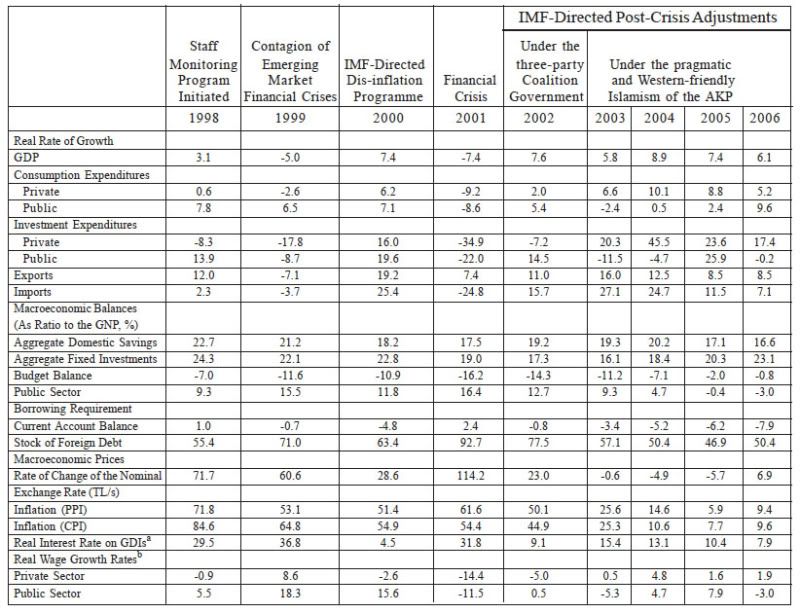

The post-2001 growth has indeed been high. Annual rate of growth of real GNP averaged 7.8% during 2002-2006. This growth, while rapid, had very unique characteristics. First, it was mainly driven by a massive inflow of foreign finance capital, which in turn was lured by significantly high rates of return offered domestically; hence, it was speculative-led in nature (Grabel, 1995). The high rates of interest in the Turkish asset markets attracted short-term finance capital, and the relative abundance of foreign exchange led to overvaluation of the Lira. Cheap foreign exchange costs led to an import boom both in consumption and investment goods. Clearly, achievement of fiscal contraction under severe retrenchment of public non-interest expenditures was a welcome event boosting the hungry expectations of the financial arbitrageurs (See Table 1). Second, the post-2001 era was characterised by its jobless-growth pattern. Rapid rates of growth were accompanied by high rates of unemployment and low participation rates. The rate of unemployment rose to more than 10% after the 2001 crisis and, despite rapid growth, has not come down to its pre-crisis levels (of 6.5% in 2000). Furthermore, together with persistent open unemployment, disguised unemployment has also risen. According to TURKSTAT data, “persons not looking for a job, but ready for employment if offered a job” increased from 1,060 thousand workers in 2001 to 1,936 thousand in 2006, bringing the total (open + disguised) unemployment ratio to 15.5% (see Table 5 in section II below).

Together with rapid growth, disinflation has been hailed as another area of “success” for the AKP government. The Central Bank (CB) has started to follow an open inflation targeting framework since January 2006. The Bank’s current mandate is to set a “point” target of 5 per cent inflation of the consumer prices. Inflation rate, both in consumer and producer prices, was in fact brought under control by 2004. Producer price inflation receded to less than 3% in late 2005. After the brief turbulence in the asset markets in May-July 2006, inflation again accelerated to above 10% and could only be brought under control gradually to 9.6% towards the end of 2006.

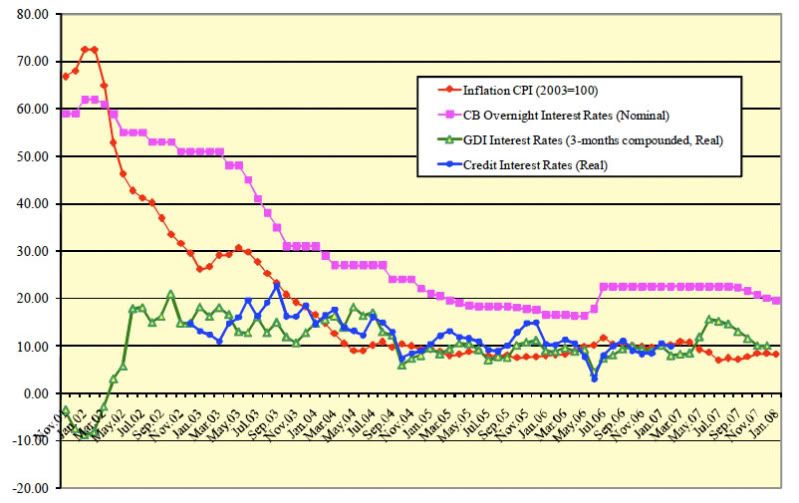

Despite the positive achievements on the disinflation front, rates of interest remained slow to adjust. The real rate of interest on the government debt instruments (GDIs), for instance, remained above 10% over most of the post-crisis period, and it placed extra pressure on the fiscal authority trying to meet its debt obligations (See Figure 1). The persistence of high real interest rates, on the other hand, was also conducive in attracting heavy flows of short-term speculative finance capital during 2003-2005. This pattern continued into 2006 at an even stronger rate.

Table 1: Basic Characteristics of the Turkish Economy Under the IMF Surveillance, 1998-2006

Notes: a. Deflated by the Producer Price Index

b. Based on real wage indexes (1997=100), in manufacturing per hour employed, Turkstat data.

Sources: SPO Main Economic Indicators; Undersecretariat of Treasury, Main Economic Indicators; TR Central Bank data dissemination system.

Inertia of the real rate of interest is enigmatic from the point of view of the successful macroeconomic performance achieved thus far on the fiscal front. Even though one traces a decline in the general plateau of the real interest rates, the Turkish interest charges are significantly higher than those in most emerging market economies. The credit interest rate, in particular, has been stagnant at 16% despite the deceleration of price inflation until the 2006 May-July turbulence. Since then the credit interest rates accelerated to 23.5% (Turkstat, 2006). The recent financial chaos that erupted in the housing and sub-prime credit markets of the US had made it necessary for CB to maintain high rates of interest against threats of contagion. So, Turkey is by now severely constrained in maintaining significantly high rates of interest into the next decade of the twenty-first century.

Figure 1: Inflation (CPI) and Real Interest Rates

Source: TURKSTAT, www.die.gov.tr.

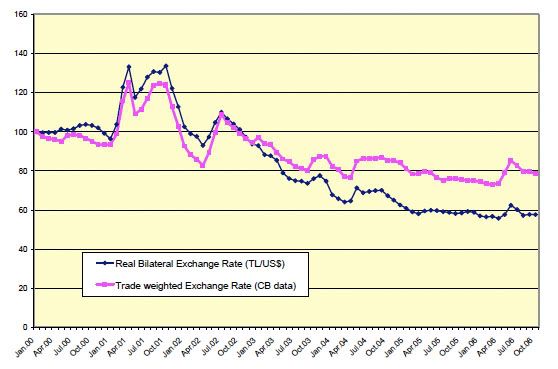

High rates of interest were conducive to the huge inflow of hot money into the Turkish financial markets. The most direct effect of the surge in foreign finance capital over this period was felt in the foreign exchange market. The over-abundance of foreign exchange supplied by the foreign financial arbitrageurs seeking positive yields placed significant pressure on the Turkish Lira to appreciate. As the Turkish Central Bank has restricted its monetary policies only to the control of price inflation and left the value of the domestic currency to the speculative decisions of the market forces, the Lira appreciated by as much as 40% in real terms against the US Dollar and by 25% against the Euro (in producer price parity conditions).

Figure 2 portrays the paths of the bilateral (vis-à-vis the US$) and the trade-weighted real exchange rate (in PPP terms, with producer prices as the deflator) over 2000-2006. The currency crises of November 2000 through February 2001 are clearly visible in the figure. The blip in May-July 2006 has had a minimal effect on the real value of the real exchange rate and was insufficient to change the direction of the course of the ongoing real appreciation.

Figure 2: Indexes of the Bilateral and Trade-Weighted Real Exchange Rate

Source: TR Central Bank and TURKSTAT.

I-1. Components of Balance of Payments and External Debt

The structural overvaluation of the Turkish Lira, not surprisingly, manifests itself in ever-expanding deficits on the commodity trade and current account balances. As traditional Turkish exports lose their competitiveness, new export lines emerge. Yet, these have proved to be mostly import-dependent, assembly-line industries, such as automotive parts and consumer durables. They use the advantage of cheap import materials, get assembled in Turkey with low value addition and then are re-directed for export. Thus, being mostly import-dependent, they have a low capacity to generate value addition and employment. As traditional exports dwindled, the newly emerging export industries have not been vigorous enough to close the trade gap.

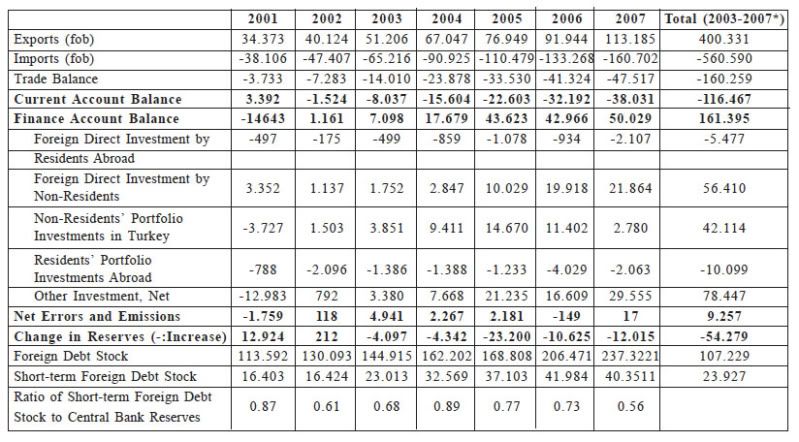

Consequently, starting in 2003, Turkey witnessed expanding current account deficits, with the figure in 2007 reaching a record-breaking $38.1 billion or 6.7% as a ratio to GNP. To be able to appreciate the significance of this figure, it must be noted that Turkey traditionally has never been a current account deficit-prone economy. Over the last two decades (80s and 90s), the average of the current account balance hovered around plus and minus 1.5-2.0%. Deficits exceeding 3% signalled significant currency adjustments as had been the case in 1994 and 2001. In fact, the mechanism of the expanding current account deficit of the post-2001 period can only be understood in the context of the speculative transactions, embedded in the finance account of the BOP. Table 2 summarizes the relevant data.

Table 2: Selected Indicators on Balance of Payments and Foreign Debt (Million US$)

Note: * As of 3rd quarter of 2007.

Source: TR Central Bank (www.tcmb.gov.tr).

Data in Table 2 indicate that the finance account has depicted a net surplus of $161.4 billion during the “AKP period” (2003-2007). About a third of this sum ($53.8 billion) was due to credit financing of the banking sector and the non-bank enterprises, while a sum of $42.1 billion originated from non-residents’ portfolio investments in Turkey. Residents exported financial capital to the tune of $10.1 billion. If one interprets the net errors and omissions term of the BOP accounts as an indicator of domestic hot money flows (see Akyuz, 2004; Boratav and Yeldan, 2005), the total sum of net speculative finance capital inflows was $41.2 billion for the post-2003 adjustments under the AKP administration.

Foreign direct investment (FDI) became an important source of financing the current account deficit especially after 2005. The BOP data reveal a sudden increase in the flow of FDI, totalling $40.7 billion in the last two years. However, looking at FDI more closely, it is revealed that the bulk of the aforementioned flow had been due to privatization receipts plus real estate and land purchases by foreigners. Neither of these items are sustainable sources of foreign exchange. They are driven by speculative arbitrage opportunities. They do not enhance the real physical capital stock of the domestic economy. In fact, as reported by the ANKA researchers, the stock of “hot money” reached $52.3 billion as of August 2006. This stock was fed by three sources: (i) foreigners’ holdings of government debt instruments ($17.9 billion) and (ii) securities in the Istanbul Stock Exchange Market ($30.6 billion); and (iii) foreign exchange deposits in the banking sector ($3.7 billion). The aggregate stock of hot money was two-thirds of the cumulative current account deficit over the post-2001 crisis period.

A significant detrimental nature of hot money-led balance of payments financing is its foreign debt intensity. As reported in Table 2, the stock of external debt increased by a total of $107.2 billion from the end of 2002 to the end of the third quarter of 2007 (the most recent data available at the time of writing). This indicates a cumulative increase at a rate of 82.3% in US dollar terms over a period of 4.5 years. Despite this rapid increase, the burden of external debt as a ratio to the GNP fell from 44.2% (2003) to 33.7% (2007). This fall was due to both the rapid expansion of the GNP and the unprecedented appreciation of the Lira over the period. The appreciation of Turkish Lira disguises much of the fragility associated with both the level and the external debt-induced financing of the current account deficit. A simple purchasing power parity “correction” of the real exchange rate, for instance, would increase the burden of external debt to 76.8% as a ratio to the GNP in 2007.5 This would bring the debt burden ratio to the 2001 pre-crisis level. Under conditions of the floating foreign exchange regime, this observation reveals a persistent fragility of the Turkish external markets; a depreciation of the Lira in the days to come may severely worsen the current account financing possibilities. This persistent external fragility was one of the main reasons why Turkey was hit the hardest among the emerging market economies in the May-June 2006 turbulence (IMF, 2006).

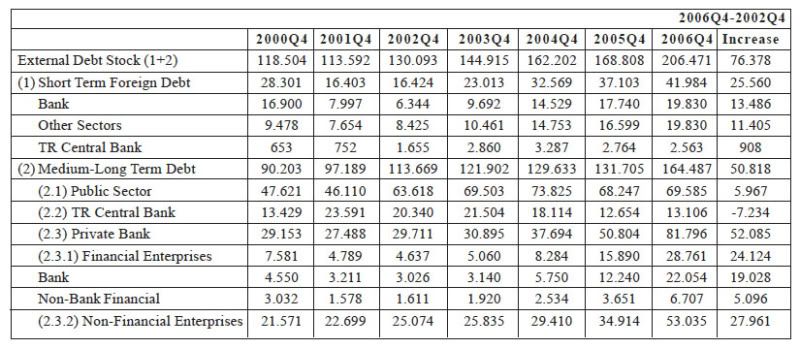

Another facet of the external fragility of the Turkish balance of payments is the composition of debt. As far as the post-2001 era is concerned, two critical features of external debt-driven current account financing have been that (i) the foreign debt accumulation was mostly of short-term duration and (ii) it was mostly driven by the non-financial private sector, rather than the public sector. The relevant data have been documented in Table 3.

Table 3: Composition of External Debt Stock (Million US$)

Source: Undersecretariat of Treasury (www.hazine.gov.tr).

As Table 3 attests, out of the accumulated foreign debt of $76.4 billion during the 2003-2006 period, 33% was short-term in maturity. Turkey’s short-term external debt stock, which had reached $28.3 billion just before the eruption of the February 2001 crisis, was reduced to as low as $13.7 billion in the first quarter of 2002. The stock of short-term debt has increased rapidly, especially after 2003, to reach $41.9 billion by the end of 2006. A critical account of this episode pertains to the ratio of short-term debt to central bank’s international reserves. This ratio is regarded as one of the crucial leading indicators of external fragility (see Kaminsky et al., 1999), and has been interpreted as the “most robust predictor of a currency crisis” in Rodrik and Velasco (1999). The path of this indicator during the post-2001 period is summarized in the last row of Table 3.

As the ratio of short-term external debt to CB’s international reserves rises, it signals a “fall” in the capability of the CB to meet the external liabilities of the domestic economy and is interpreted as a worsening ofexternal fragility. This ratio stood at 0.87 at the end of 20016 and, after receding to 0.61 in early 2002, rose to 0.92 by the third quarter of 2005. It was brought back to 0.74 by the third quarter of 2006, thanks mainly to very rapid build-up of foreign exchange reserves by the Turkish central bank in the previous year. By way of comparison, the aforementioned “fragility ratio” was 0.60 in Malaysia, 0.91 in the Philippines and 1.50 in Thailand just before the breakout of the 1997 Asian crisis. Thus, it can be argued that 0.60 is regarded as a critical threshold from an international speculation point of view (see Kaminsky et al., 1999).7

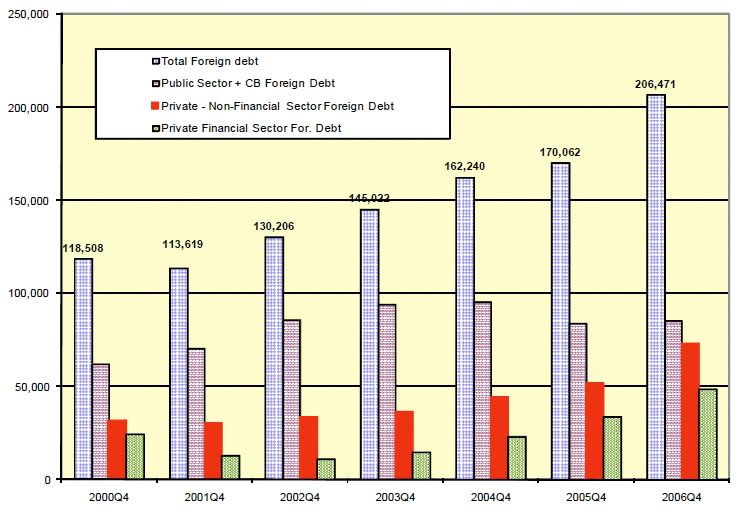

Within the private sector, non-financial enterprises explain 60% of the aggregate increase of private external debt over the post-2002 AKP period and account for 70.9% of the total stock of private debt by 2007 (see Figure 3).

Figure 3: External Debt by Sectors

Source: TR Central Bank, www.tcmb.gov.tr.

I-2. The “IMF Program”

The rapid increase of private sector debt — both by the financial and non-financial sectors alike — reveals the true essence of the IMF-engineered adjustment mechanisms following the currency and banking crises of February 2001. The underlying characteristics of the Turkish post-crisis adjustments ultimately relied on maintaining high real rates of interest in anticipation of increased foreign capital inflow into the domestic economy. Coupled with an overall contractionary fiscal policy, the programme found the main source of expansion in speculative inflows of foreign finance. Persistent offerings of high rates of interest against the back-drop of lower inflation and primary fiscal surplus targets were the main attributes of the IMF programme as implemented both by the three-party coalition government under Mr Bulent Ecevit (until November 2002) and by the AKP government (post-November 2002).

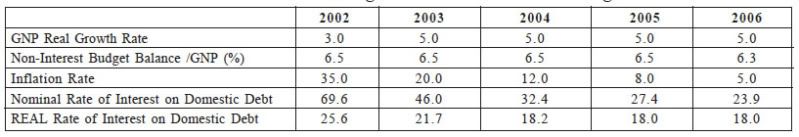

The aforementioned elements of this adjustment path were clearly stated, in fact, in the Turkey Country Report prepared by the IMF staff in late 2001. Table 4 below makes a reference to that report which had laid out the macroeconomic targets of the post-crisis adjustment path as envisaged by the IMF. It is illuminating to note that the targets of the 2001 IMF Report encompassing 2002 through 2006 have eventually become the official targets of both governments during that period. The targeted rate of real GNP growth, for instance, was persistently set at 5% for each coming year, despite the observed rapid expansion of the economy in rates often exceeding 7% in the preceding year! This choice was clearly no coincidence. Likewise, the inflation targets of the “independent” central bank each year followed the path envisaged in the 2001 IMF Report, beginning with 20% in 2003 to 5% in 2006. It should be noted that the Turkish CB has declared the onset of its official inflation targeting monetary regime on 1 January 2006.

Finally, the sanctimonious primary surplus target of the public sector at 6.5% as a ratio to the GNP clearly finds its origins in the aforementioned report.

Table 4: Macroeconomic Targets of the Current IMF Programme

Source : IMF, 2001, Turkey Country Report (www.imf.org).

What remains noteworthy is the IMF’s choice of a very high and persistent real interest rate targeted at 18% throughout the programming horizon. The real interest rate target is persistently kept at this very high level despite the falling trajectory of the inflation rate. As is evident from Figure 1 above, where the realized rates of inflation and real interest were disclosed, the persistence of the high level of real interest rate against falling inflation rates seems to find a resonance in the adjustment path assumed by the IMF staff immediately after the 2001 crisis. It is clear that the main adjustment mechanism of the post-crisis IMF programme was embedded in maintaining a significantly high rate of real interest. The high interest rates attracted short-term finance capital, and the relative abundance of foreign exchange led to overvaluation of the Lira. Cheap foreign exchange costs led to an import boom both in consumption and investment goods. Achievement of the fiscal contraction under severe retrenchment of public non-interest expenditures, in turn, was a welcome event further boosting the hungry expectations of the financial arbitrageurs.

In sum, contrary to the traditional stabilization packages that aimed at increasing interest rates to constrain the domestic demand, the new orthodoxy had its aim at maintaining high interest rates to attract speculative foreign capital from the international financial markets. The end results in the Turkish context were the shrinkage of the public sector in a speculative-led growth environment, and the consequent deterioration of education and health infrastructure necessitating urgent increase of public funds. Furthermore, as the domestic industry intensified its import dependence, it was forced to adopt increasingly capital-intensive foreign technologies with adverse consequences on domestic employment. The next section will deal with this issue.

II. Persistent Unemployment and Jobless Growth

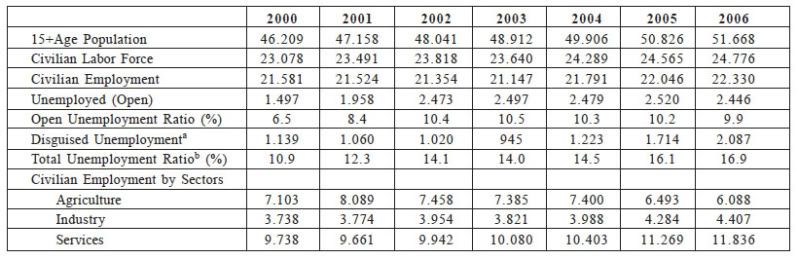

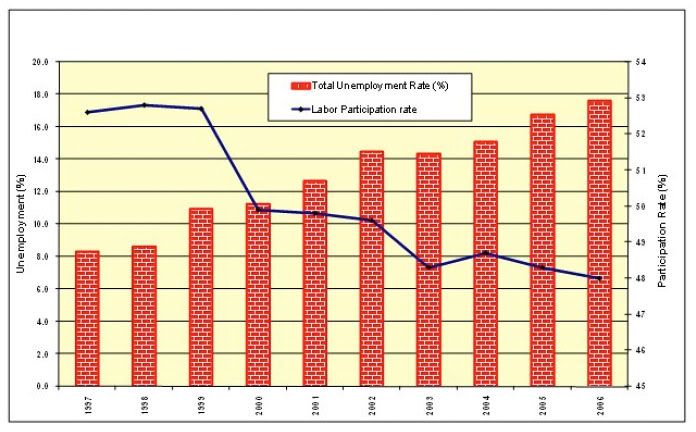

A key characteristic of the post-2001 Turkish growth path has been its “jobless” nature. The rate of open unemployment that was 6.5% in 2000 increased to 10.3% in 2002 and remained at that plateau despite the rapid surges in GDP and exports. Open unemployment is a severe problem; in particular, open unemployment among the young urban labour force touched 26% by 2007. Table 5 tabulates pertinent data on the Turkish labour market.

Table 5: Developments in the Turkish Labour Market (1,000 persons)

Notes: a. Persons not looking for a job yet ready to work it offered a job: (i) Seeking employment and ready to work within 15 days, and yet did not use any of the job search channels in the last 3 months; plus (ii) discouraged workers.

b. Total (open + disguised) unemployment accounting for the persons “not in labour force”.

Source: Turkish Statistical Institute (TURKSTAT), Household Labour force Surveys.

The civilian labour force (ages 15+) was 51.6 million in 2006. The participation rate, however, fluctuated between 48% and 50%, due mostly to the seasonal effects. In general, the participation rate is less than the European Union (EU) averages. This low rate is principally due to women choosing to remain outside the labour force, a common feature of Islamic societies; but its recent debacle can largely be explained by the size of the discouraged workers who have lost the hope of finding jobs. If we add the TURKSTAT data on the underemployed people, the excess labour supply (unemployed + underemployed) is 16.9% of the labour force.

Yet the most striking feature of the Turkish labour markets over the post-2001 crisis era is the slow growth of the employment generation capacity of the economy. Despite the very rapid growth performance across industry and services, employment growth has been insignificant. This observation, which is true of many developing economies as well,8 is characterized by the phrase jobless-growth in the literature. In Turkey this problem manifests itself in insufficient employment generation despite the very rapid growth especially after 2002.

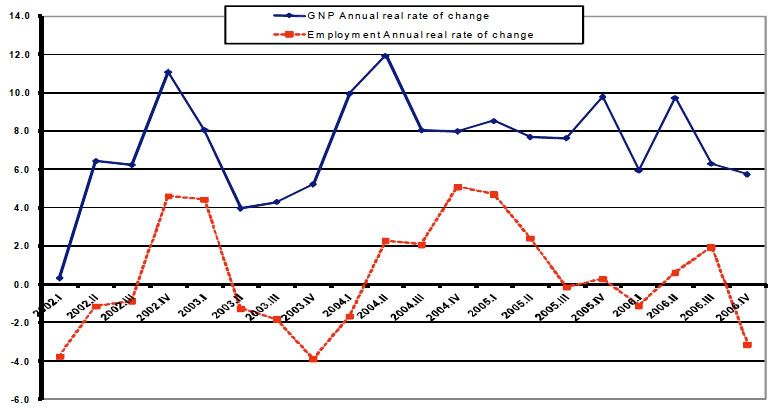

To elucidate this assessment, the quarterly growth rates in real gross domestic product (GDP) are plotted in Figure 4, and the y-o-y annualized rates of change in labour employment are compared. In order to make the comparisons meaningful, the changes in labour employment is calculated relative to the same quarter of the previous year.

Figure 4: Annual Rate of change in GDP and Aggregate Employment

Source: Turkish Statistical Institute (TURKSTAT), Household Labour Force Surveys.

Between Q1 of 2002 and Q4 of 2006, the average rate of growth in real GDP was 7.5%. In contrast, the rate of change of employment averaged only 0.8% during the same period. During the twenty quarters portrayed in the figure, GDP growth was positive in all periods. Yet, labour employment growth was negative in 10 of those 20 quarters.

The sectoral breakdown of the post-crisis employment patterns reveals a massive de-population in the rural economy. Agricultural employment has been reduced by 1,289 thousand workers since 2001. Against this fall, there has been a total increase of employment in the services sectors by 2,380 thousand and by 655 thousand in industry. Simultaneously, the overall aggregate labour supply expanded from 47.158 million in 2001 to 51.770 million in 2006, adding to the acuteness of the joblessness problem.

Thus, two important characteristics of the post-crisis adjustment path stand out. Firstly, the post-2001 expansion is concomitant with a deteriorating external disequilibrium, which in turn is the end result of excessive inflows of speculative finance capital, referred to as “speculative-led” in the preceding section. Secondly, a sharp contrast can be seen between output growth and persistent unemployment, warranting the term “jobless growth“.

A further detrimental impact of the speculative-led, jobless-growth era has been the overall decline in the labour participation rates. Even though lower than those for the comparable member countries of the EU, labour participation rates were nevertheless above 50% during most of the 1990s. The participation rate declined to less than the 50% threshold during the implementation of the 2000 exchange rate-based disinflation programme. It continued its secular decline over the rest of the decade. This trend is depicted in Figure 5.

Figure 5: Labour Participation Rate and Total Unemployment

Source: Turkish Statistical Institute (TURKSTAT), Household Labour Force Surveys.

III. Wage-Labour as the Absorber of the Burden of Adjustments

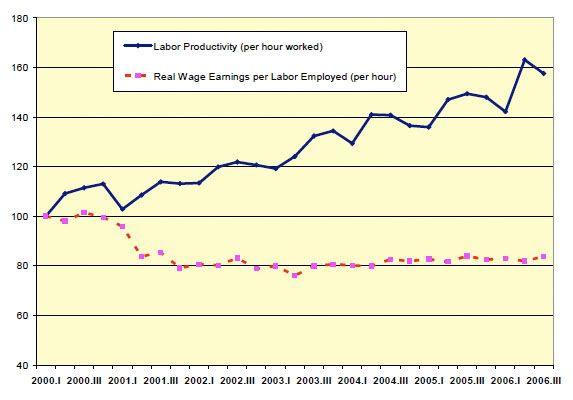

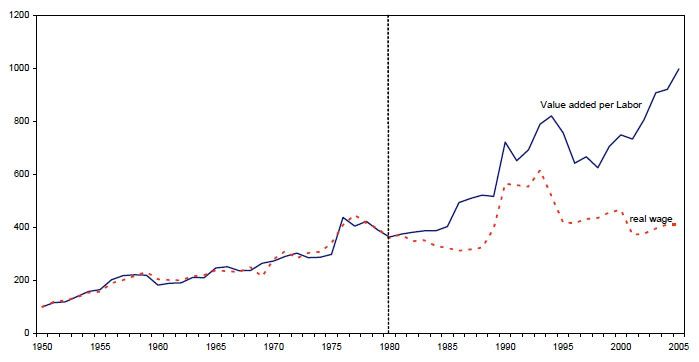

Such a transfer of the financial surplus through very high real interest rates offered to the financial system would, no doubt, have repercussions on the primary categories of income distribution. It is clear that creation of such a financial surplus would directly necessitate a squeeze of the wage fund and a transfer of the surplus away from wage-labour towards capital incomes. Evidence of the extent of this surplus transfer from the path of the manufacturing real wages exists. The dynamics of the manufacturing real wages is portrayed in Figure 6 and contrasted against productivity of labour.

Figure 6: Real Wages and Labour Productivity in the Turkish Manufacturing Industry

Source: Turkish Statistical Institute (TURKSTAT).

The index of labour productivity, measured in real output per hours, shows a rapid increase with its level reaching 158 index points (1997=100) by 2006 Q3. During the same period, wage remunerations declined by a cumulative 23.8% in real terms. This exercise shows clearly that in the Turkish economy, speculative financial gains were financed through the squeezing of real wages. Each rapid rise in financial returns was closely associated with a downward movement of real wages and involved a direct transfer from labour incomes towards capital, both domestic and foreign.9 Real wages contracted severely after the February 2001 crisis, and this downward trend was maintained throughout 2002 and 2003.

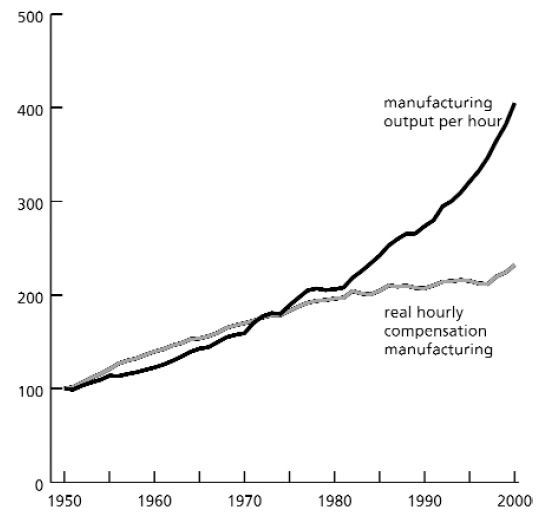

The ongoing process of surplus transfer from wage-labour to the financial-industrial conglomerates is not new and is not unique to Turkey in any case. Capital’s assault on labour has, in fact, continued with new forms of industrial organization with the onset of neo-liberal globalization in the mid-70s. With intensified policy changes towards flexibility and privatization, the position of wage-labour eroded. This process was most visible in the US, the hegemonic centre of global capitalism. In order to understand this phenomenon, the path of real wages and real labour productivity in US manufacturing in the second half of the 20th century is depicted in Figure 7 below. As is clearly visible, the Fordist period under the Keynesian policies was associated with real wages, following, to a large extent, the movements in labour productivity until the 1970s. The late 1970s, however, reveal the extent of capital’s gains over labour. As the real wage rate stagnated, its path remained significantly below the real average product of labour; in the last quarter of the century, the gap widened due to the increased exploitation of wage labour.10

Figure7: Labour Productivity and Hourly Real Wages in US Manufacturing (1950 = 100)

Source: “The New Face of Capitalism: Slow Growth, Excess Capital and A Mountain of Debt,” Monthly Review, Editors, 2002.

A different facet of this observation was at play across the Atlantic as well. Figure 8 below contrasts the US wage labour’s position with that of Turkey. The figure portrays comparable data and the verdict remains exactly the same. Wage rates of the Turkish manufacturing labour followed the average real product until 1980, but under conditions of military dictatorship during the 1980s, a significant wedge is created among the real wage earnings and real labour productivity by way of intensified exploitation of labour.

Figure 8: Labour Productivity and Real Wages in Turkish Manufacturing (1959-2005)

Source: TURKSTAT, Annual Manufacturing Surveys.

Clearly, very similar processes had been operational both in the North and South under neoliberal globalization. The end of the Fordist technological organizations led to the demise of the welfare state which enabled a comparatively tolerant attitude towards wage labour. As this delicate balance on mass production for domestic consumption eroded, capital found a new opportunity in financial returns. Overall, this process has led to the demise of the welfare state and an outright hostile attitude to the rights of labour.

As a result, everywhere, the share of labour in national incomes fell. According to Petras and Veltmeyer’s (2000) and Diwan’s (1999) data, the share of wage labour fell from 48% (1970) to 28% (1985) in Chile; from 41% (1970) to 25% (1989) in Argentina; from 37% (1970) to 27% (1989) in Mexico; and from 40% (1970) to 17% (1986) in Peru. Similarly, according to calculations of Yeldan (2000, Chapter III), the share of wage labour in manufacturing value added was reduced from 28% in 1976 to 15% by 1987. This abrupt shift in the distribution of income against labour coincided with the assault against indigenous strategies for economic development and against the fragile democracies of the “South”.

IV. Conclusion: From “Fiscal” to “Democracy” Deficit

The detrimental effect of the neoliberal adjustment path on wage labour was not limited to the economic sphere. Labour’s position was further weakened as developing country governments, dependent on foreign capital, have been conditioned to adopt or maintain contractionary policies in order to secure “investor confidence” and “international creditworthiness”. Such efforts are directed at a balanced budget, retrenched fiscal expenditures, and a relatively contractionary monetary policy with an ex ante commitment to high real interest rates. All of these signify reduced political autonomy in the developing world in exchange for market access to the industrialized North; clearly, it is a bad bargain as far as development is concerned (Rodrik, 2001).

In such an environment, portfolio investors become the ultimate arbiters of national macroeconomic policy (Cizre-Sakallioglu and Yeldan, 2000; Grabel, 1996), and any effective public policy is now regarded as populist and a waste. Democratic institutions are put under siege through endless lists of conditionalities imposed by the IMF and the World Bank. In the meantime, transnational companies and international finance institutions (IFIs) have become the real governors with an implicit veto power over any economic and/or political decision that is likely to act against the interests of global capital. The IFIs report rating scores in aligning the indigenous economies under the strategic realm of finance capital. Even direct political decisions are under scrutiny.

A critical example here is the rejected war motion by the Turkish parliament, disapproving the request for US troops to use the Turkish soil in the early days of Iraq’s invasion. In exchange for a total aid of 24 billion dollars, the US had sought Turkey’s permission to use its borders with Iraq. The motion was rejected and chaos ensued, incited by the IFIs and their rating agencies. The following excerpt from Morgan Stanley Economic Forum on Turkey (4 March 2003) is a typical example:

“the latest parliamentary decision to reject the much-debated ‘war motion’ is such a risk that will no doubt disturb the fragile equilibrium . . . (Turkey) is unlikely to get the promised $24 billion that would ease pressure on the domestic debt market. . .”

The report concludes with the stunning question:

“what happens if the parliament does not altogether vote for the economic reforms, arguing that 80% of the Turkish population is against the IMF program?”

Thus, the report is not only concerned with the loss of 24 billion dollars liquidity for the Turkish financial centres, but is also worried that the people may further exercise their rights over the future of the IMF-led austerity programme in Turkey. The words of Diaz-Alejandro (1985) are chillingly pertinent here: “Goodbye Budget deficits, hello democracy deficit. . . .”

The 2005 Annual Report of the ISSA point out two important consequences of these transformations that come to the fore as the basic problem of almost all countries including Turkey. These are related to the transfer of decisions relating to the public sphere from constitutional institutions of respective countries to “independent” supreme bodies of regulation working under global rules and further commercialisation of the public services and the overall body of public economic activity including decision making and regulation (ISSA, 2006: 4). This process, whose legitimization is presented as “dissecting politics from economics“, enhances the hegemony of global capital and its domestic extensions on society, by keeping large sections of people and working masses away from political processes. Political leaders in all countries where these reforms are being implemented commonly refer to clumsily working “old” state and bureaucratic structures, also lamed by corruption, and the new model is championed by reference to its so-called efficient, strong, rule-abiding and accountable features.11

Reports containing policy suggestions not only define necessary measures and arrangements to be adopted, but also offer advice on how to secure public support in this field. The example below is from an OECD Report (2002) titled Regulatory Reforms in Turkey: Important Support to Economic Improvement: Governance:

“. . .It is vital to have open communication channels in order to have continued public support for the reforms. There is a need for dissemination of the targets and the advantages of the regulatory reforms. Another benefit of this approach is to eliminate the widespread public view that the reforms are imposed from abroad. For this reason, the public perception should be treated as an important issue within the communication strategy of the government.” (Page 11, underlined emphasis added).

An assessment of the processes which the so-called “emerging market economies” have undergone under neoliberal globalization makes it clear that what has been pursued is not simply a move to “stabilize” the economic structures but it goes much beyond. It seeks to radically alter the social structures of these nations. The executing actors include politicians who refuse to take note of the feedback from different segments of the society justify their stance by repeating “it is us who decide on policies to be adopted” and maintain these policies at any cost while remaining content with the slogan “firm commitment is a virtue“. Top level bureaucrats, whom we can classify as “global elites”, often share the same mode of living and discourse worldwide. Extremely intolerant of any criticism including very innocent ones, these groups may well be far removed from what is the sine qua non of any democracy.

Notes

* Earlier versions of this paper were presented at the annual meeting of the Union for Radical Political Economics (URPE), Chicago, 5-7 January 2007, and in the seminars at the Economic Policy Institute (EPI) Washington, DC and University of Massachusetts, Amherst. I thank Richard Anker, Robert Blecker and Tony Avirgan for their invaluable suggestions and comments. This paper was researched during my stint as a visiting Fulbright scholar at the University of Massachusetts, Amherst. I acknowledge the generous support of the J. William Fulbright Foreign Scholarship Board and the hospitality of the Political Economy Research Institute at UMass, Amherst.

1 The underlying elements of the disinflation programme and the succeeding crisis are discussed in detail in Akyuz and Boratav (2004); Ertugrul and Yeldan (2003); Yeldan (2002); Boratav and Yeldan (2006); and Alper (2001). Also see the GPN Report on Turkey (2005) and the website of the Independent Social Scientists Alliance (www.bagimsizsosyalbilimciler.org) for further details of the crisis conditions.

2 In fact, many analysts draw parallels between the three-party coalition government’s declaration in the summer months of 2002 granting no support to US plans to invade Iraq, and the decision to hold early elections later in the same year.

3 i.e., balance on non-interest expenditures and aggregate public revenues. The primary surplus target of the central government budget was set at 5% to the gross national product (GNP).

4 The target for consumer price inflation was set at 5% for 2006, and 4% for 2007 and 2008.

5 Measured in 2002 producer prices. If the PPP-correction is calculated in 2000 prices, the revised debt to GNP ratio reaches 82.3%.

6 The ratio of short-term foreign debt to CB’s international reserves was 1.47 just before the eruption of the February 2001 crisis.

7 See Goldstein (2005) for a recent evaluation of the external fragility accross emerging market economies. Turkey is reportedly found to display above average fragility indexes among comparable economies. Also see the IMF’s 2006 report on Turkey for further discussion.

8 See UNCTAD, Trade and Development Report, (2002 and 2003).

9 See also Yeldan (2006) for a more detailed assessment of labour’s position under the post-crisis adjustments of the Turkish economy.

10 See Moseley (2001), and the reports by the Economic Policy Institute on the position of US labour.

11 Those interested in a more elaborate and advanced analysis of these reforms and the new State in agenda as well as the new public sphere may refer to the websites of the IMF, WB, OECD or EU.

References

Akyüz, Yilmaz and Korkut Boratav (2003) “The Making of the Turkish Crisis”, World Development, 31(9), pp. 1549-1566.

Alper, Emre (2001) “The Turkish Liquidity Crisis of 2000: What Went Wrong?” Russian and East European Finance and Trade, Vol. 10, No. 37, pp. 51-71.

Alper, Emre and Ziya Öniş (2003) “Emerging Market Crises and the IMF: Rethinking the Role of the IMF in the Light of Turkey’s 2000-2001 Financial Crises”, Canadian Journal of Development Studies, Vol. 24, No. 2, pp. 255-272.

Anka News Agency, Daily Economic Report, 1 September 2006.

Boratav, K. (2006) “Ilk Dokuz Ayda Sermaye Hareketleri”, SoL Meclis, www.sol.org.tr/index.php?yazino=5209.

Boratav, Korkut and Erinç Yeldan (2006) “Turkey, 1980-2000: Financial Liberalization, Macroeconomic (In)-Stability, and Patterns of Distribution” in Lance Taylor (ed.) External Liberalization in Asia, Post-Socialist Europe and Brazil, Oxford University Press, pp. 417-455.

Cizre, Umit and Erinc Yeldan (2005) “The Turkish Encounter with Neo-Liberalism: Economics and Politics in the 2000/2001 Crises”, Review of International Political Economy, 12(3), pp. 387-408, August.

Cizre Sakallıoglu, Umit and Erinç Yeldan (2000) “Politics, Society and Financial Liberalization: Turkey in the 1990s”, Development and Change, 31(1), pp. 481-508.

Diaz-Alejandro, Carlos F. (1985) “Good-Bye Financial Repression, Hello Financial Crash”, Journal of Development Economics, 19(1-2), pp. 1-24, February.

Economic Policy Institute (EPI) (2006) The State of Working America, Washington D.C.: The EPI Press.

Ertugrul, Ahmet and Erinc Yeldan (2003) “On The Structural Weaknesses of the Post-1999 Turkish Dis-Inflation Program”, Turkish Studies Quarterly, 4(2), pp. 53-66, Summer.

Goldstein (2005) “What Might the Next Emerging-Market Financial Crisis Look Like?” Institute for International Economics, Working Paper No. 2005-07, July.

Grabel, Ilene (1996) “Marketing the Third World: The Contradictions of Portfolio Investment in the Global Economy”, World Development, 24(11), pp. 1761-1776.

__________(1995) “Speculation-Led Economic Development: A Post-Keynesian Interpretation of Financial Liberalization Programmes in The Third World”, International Review of Applied Economics, 9(2), pp. 127-149.

IMF (2006) “Staff Report on Turkey”, IMF Country Reports No. 06/402, November.

(ISSA) Independent Social Scientists Alliance (2006) Turkey and the IMF: Macroeconomic Policy, Patterns of Growth and Persistent Fragilities, Penang, Malaysia: Third World Development Network.

(ISSA) Independent Social Scientists Alliance (2005) 2005 Başında Türkiye’nin Ekonomik ve Siyasal Yaşamı Üzerine Değerlendirmeler, www.bagimsizsosyalbilimciler.org/Yazilar_BSB/BSB2005Mart.pdf.

Kaminsky, Graciela and Carmen Reinhart (1999) “The Twin Crises: The Causes of Banking and Balance-of-Payments Problems”, American Economic Review, 89(3), pp. 473-500, June.

Moseley, Fred (2001) “The Rate of Profit and Stagnation in the US Economy”, in Baiman, Ron, Heather Boushey and Dawn Saunders (eds.) Political Economy and Contemporary Capitalism, London and New York: Sharpe, pp. 57-59.

Petras, James and Henry Veltmeyer (2001) Globalization Unmasked: Imperialism in the 21st Century, London and New York: Zed Books.

Rodrik, D. and Andres Velasco (1999) “Short Term Capital Flows”, Proceedings of the Annual World Bank Conference on Development Economics, Washington, DC.: The World Bank, pp. 59-90.

Rodrik, Dani (2001) “The Global Governance of Trade As If Development Really Mattered”, Paper presented at the UNDP Meetings, New York, 13-14 October 2000.

Telli, Cagatay, Ebru Voyvoda and Erinç Yeldan (2006) “Modeling General Equilibrium for Socially Responsible Macroeconomics: Seeking for the Alternatives to Fight Jobless Growth in Turkey”, METU Studies in Development, forthcoming.

Voyvoda and Yeldan (2006) “Macroeconomics of Twin Targeting in Turkey: A General Equilibrium Analysis”, June, www.bilkent.edu.tr/~yeldane/econmodel/Voyvoda&Yeldan_AltIT-Turkey_2006.pdf.

Yeldan, Erinç (2006) “Neo-Liberal Global Remedies: From Speculative-led Growth to IMF-led Crisis in Turkey”, Review of Radical Political Economics, 38(2), pp.193-213, Spring.

Yeldan, Erinç (2002) “On the IMF-Directed Disinflation Program in Turkey: A Program for Stabilization and Austerity or a Recipe for Impoverishment and Financial Chaos?” in N. Balkan and S. Savran (eds.) The Ravages of Neo-Liberalism: Economy, Society and Gender in Turkey, New York: Nova Science Pub.

Yeldan, Erinç (2001) Küreselleşme Sürecinde Türkiye Ekonomisi Bölüşüm, Birikim ve Büyüme, Istanbul: Iletişim Publications.

A. Erinç Yeldan is Professor at the Department of Economics, Bilkent University, Ankara. “Patterns of Adjustment in the Age of Finance: The Case of Turkey as a Peripheral Agent of Neoliberal Globalization” was published by the International Development Economics Associates on 9 February 2009. It is reproduced here for educational purposes.