With the economy suffering from near double-digit unemployment, public debate is dominated by concerns over the budget deficit and national debt. This discussion is unfortunate both because there is no reason for people to be concerned about the deficit at present, and more importantly, because it discourages action on the unemployment crisis that is devastating the country.

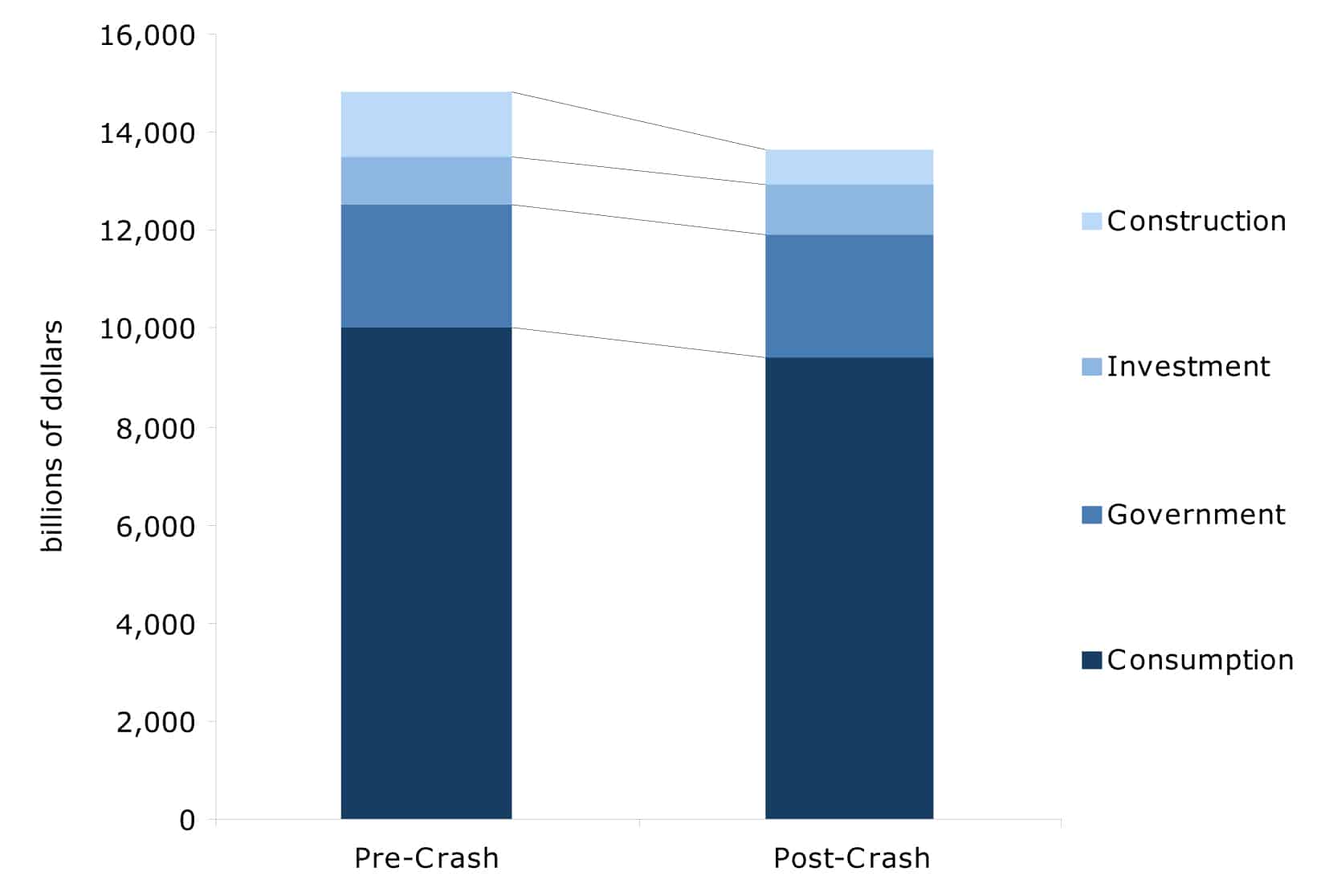

The basic outlines of the current situation are fairly simple. The economy was operating at near full employment levels of output in 2007, before the collapse of the housing bubble threw the economy into the most severe recession since the Great Depression. When the bubble burst, construction plummeted as builders realized that there would be no demand for the houses they were building. There was also a bubble in non-residential real estate leading to a building boom in retail and office space, as well as hotels. Non-residential construction also collapsed in response to this over-building. The combined falloff in annual residential and non-residential construction spending has been close to $600 billion.

The collapse of the housing bubble also sent consumption plummeting. The bubble had generated more than $8 trillion of additional housing equity. Homeowners spent against the equity created by the housing bubble just as they would against their other housing equity, since they did not know the equity came from a bubble. Economists usually estimate the size of the housing wealth effect as 5-7 percent, meaning that the $8 trillion in bubble- generated equity would have led to $400 billion to $560 billion a year in annual consumption.

Thus far, the bubble is close to two-thirds deflated, meaning that the value of housing has fallen by close to $6 trillion. This would imply a drop in annual consumption of between $300 billion and $420 billion.

The decline in consumption was amplified by the plunge in the stock market, which lost more than $6 trillion in wealth (even after its bounce- back from 2009 lows) as the economy plunged into recession. With a stock wealth effect of 3-4 percent, this translates into a drop in annual consumption demand of between $180 billion and $240 billion.

The combined impact of the drop in house prices to date and the loss of stock wealth should be a falloff in annual consumption of between $480 billion and $660 billion. The mid-point of this range would imply a drop in annual consumption of $570 billion. Adding this to the $600 billion drop in construction spending implies a falloff in annual demand of $1,170 billion.

This dropoff is shown in Figure 1, which shows the components of GDP before and after the collapse of the housing bubble. (Net exports are excluded for simplicity.)

FIGURE 1: Components of GDP, before and after the Collapse of the Housing Bubble

As can be seen, GDP is much lower post-crash since there is nothing to replace the demand lost as a result of the collapse of the housing bubble.

In response to a modest downturn, it is possible for the Federal Reserve Board to lower interest rates, which in turn boosts investment and consumption, and also housing construction. In this downturn, the Fed has lowered interest rates as far as it can — all the way to zero — but it has had relatively little effect. The reason that this drop in rates has had a limited impact is that it cannot make up for the huge amount of lost housing equity. Also, low interest rates are not likely to spur much construction in an economy where there is already a glut of housing, retail stores, office space, and hotels.

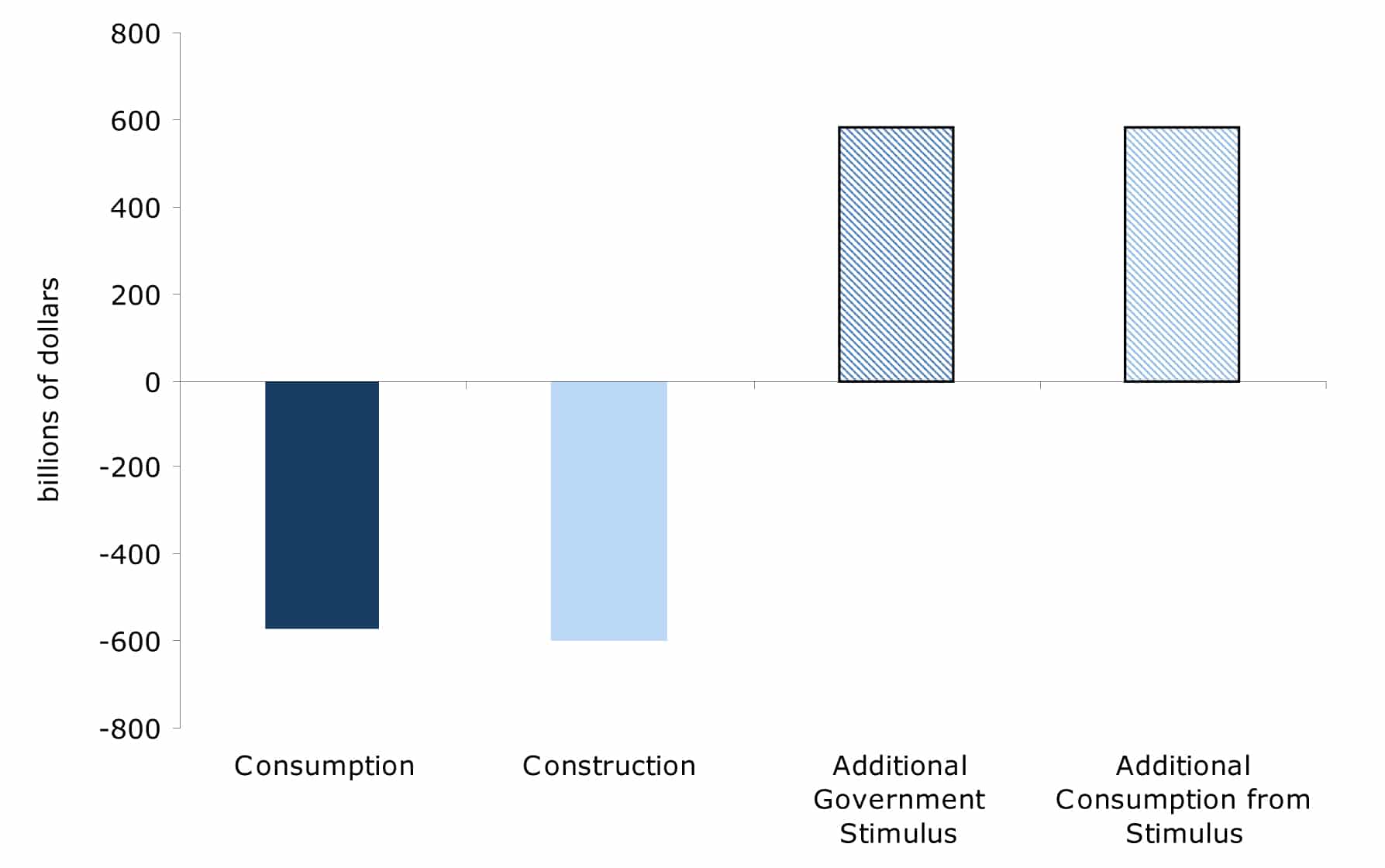

The drop in interest rates has benefited the economy, but not nearly enough to offset the huge loss in demand from the collapse of the housing bubble. This is the reason that stimulus is needed. The government can bring the economy closer to full capacity by spending money directly. For example, it can spend more on services like education, health care, or police and fire protection or on investment in areas like infrastructure or research and development. The government can also boost consumption by giving tax breaks to those who are most likely to spend the money.

Through a combination of additional government spending and tax breaks the government can bring the economy back to a full employment level of output. This is shown in Figure 2, which assumes that the gap created by the collapse of the housing bubble (in construction and consumption) is closed with equal amounts of spending increases and consumption generated by tax cuts.

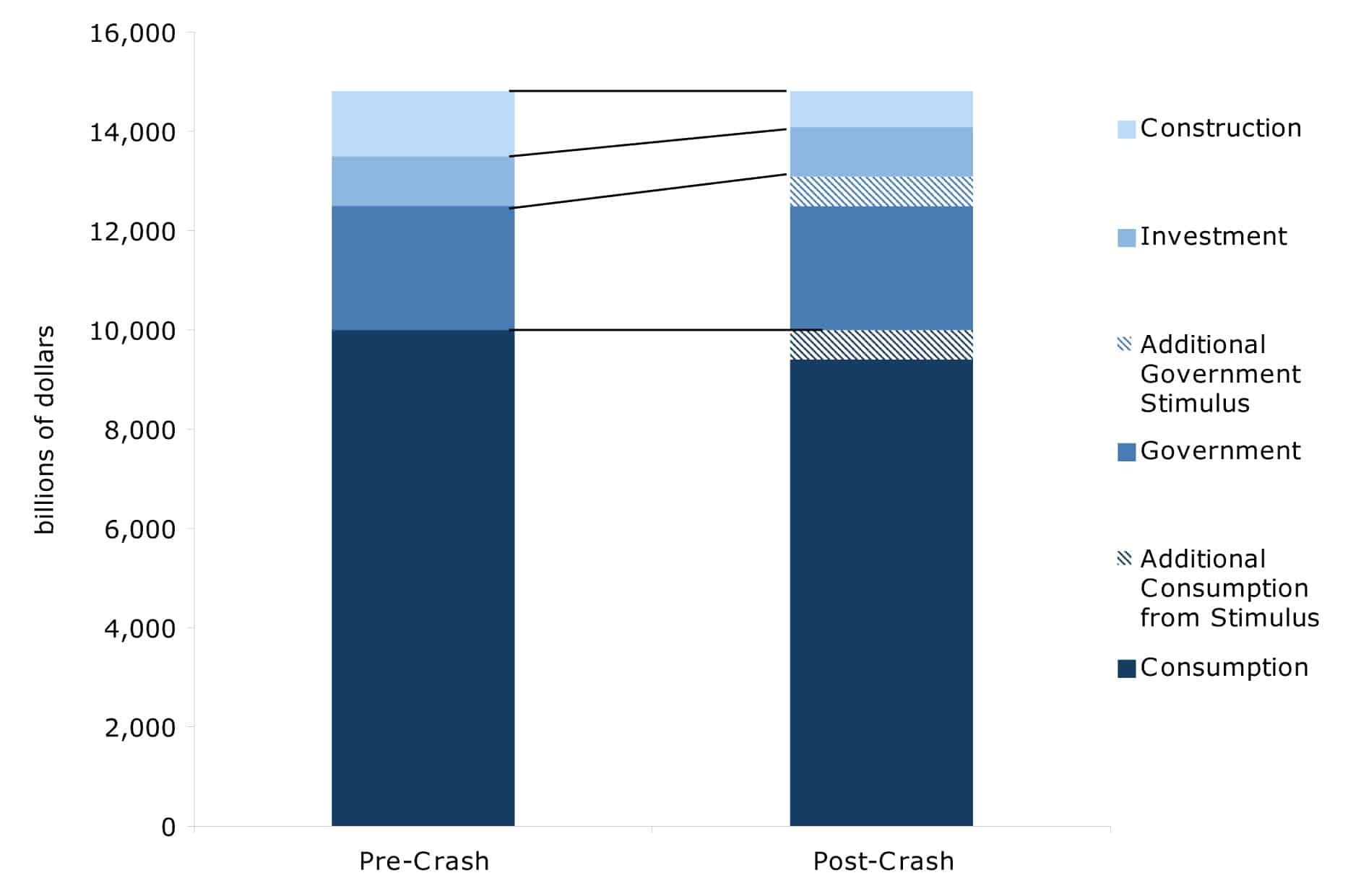

Figure 3 then updates the post-crash levels shown in Figure 1 to demonstrate the adjustments necessary to get the economy to a level of demand closer to full employment. This effectively assumes that the additional spending, financed through borrowing, has no negative effects on the other components of GDP. In a more typical economic environment, this would be an unreasonable assumption. However, in the extraordinarily deep downturn that the economy is currently experiencing, this is likely to be a reasonable approximation of reality. Increased government borrowing will have little effect on interest rates, and therefore it will not crowd out other components of GDP.

FIGURE 3: Effects of Additional Government Spending and Tax Breaks on GDP

While many, if not most, economists would agree with this basic picture, the question raised by those concerned about the debt is that this additional borrowing will impose a substantial interest burden on the United States in future years. Given the extraordinarily low interest rates in the market at present, this concern does not seem terribly realistic. For example, if the United States government borrowed $4 trillion in 30-year bonds at a 3.7 percent interest rate (approximately the current level), then it would imply an annual interest burden of $148 billion. This is less than 0.7 percent of projected GDP for 2020, which is hardly an unmanageable amount. However, it is possible to ensure that the government does not bear even this burden of addition interest expenses.

Suppose the Federal Reserve Board were to buy and hold the additional bonds issued to finance a larger stimulus package. For example, suppose the government borrowed an additional $800 billion (beyond what is currently projected) in both fiscal years 2011 and 2012 to pay for more stimulus. The Fed could simply buy up these bonds by issuing more reserves. There is little need to fear that this injection of more reserves into the banking system would lead to inflation in the current situation, since the economy has an enormous amount of unemployed labor and idle resources.

Furthermore, it would be beneficial to the economy if the Fed’s actions did lead to somewhat more inflation. A higher rate of inflation would reduce the real interest rate, making firms more willing to invest. If inflation rose to a 3.0-4.0 percent range, then it would mean that firms could expect to sell products they produce in 4-5 years at prices that are far higher than current prices. (A 4 percent inflation rate implies that prices will be 20 percent higher in 5 years, before taking into account compounding.) If firms know that they will be able to sell their output at much higher prices in the near future, then it will be far more profitable to invest today.

In the same vein, a higher rate of inflation will reduce debt burdens. If wages rise in step with inflation, and inflation averages 4.0 percent over the next 5 years, then wages will be approximately 20 percent higher 5 years from now. This will reduce the burden of mortgages or other debts where the size of the monthly payment remains fixed. In addition, if house prices rise in step with inflation, then a higher rate of inflation will translate into additional home equity (as the value of homes rises, the size of mortgages will remain unchanged).

For these reasons, any inflation that resulted from the Fed’s decision to buy large amounts of debt at present would be a plus for the economy rather than something to be feared. If inflation threatened to get out of control, then it would be a serious problem, but there is little possibility that this could happen given the depth of the downturn. Furthermore, inflation does not just begin skyrocketing overnight in developed economies. Inflation increases gradually in response to excess demand. If there was evidence that tight labor markets or bottlenecks in production were creating inflationary pressures, then the Fed would have plenty of time to reverse course and adopt policies to slow the economy. In short, the decision to buy large amounts of debt at present holds little risk.

Of course the Fed has already been buying large amounts of debt, although most of its purchases have been of mortgage-backed securities, not government debt. As a result of its large holding of debt, the Congressional Budget Office projects that the Fed will rebate $77 billion to the Treasury in 2010.1 This amount is more than 37 percent of the government’s current net interest burden.

The Fed’s decision to buy large amounts of debt at present is largely non-controversial, however the generally held view is that the Fed will sell this debt back to the public over the next few years. This means that the government debt currently being issued, as well as an increase in the debt needed to finance additional stimulus, will ultimately be in the hands of private investors. At that point, the interest burden on this debt will pose a burden on the government, even if it is a relatively manageable one.

However, there is a simple alternative. The Fed can simply commit itself to hold government debt indefinitely. This way the interest on the bonds issued by the government will continue to go to the Fed and then be rebated back to the Treasury. In this scenario, there is no future interest burden on the government whatsoever created by its current stimulus spending.

There is a concern that the additional reserves that the Fed has put into the system to buy government debt will create inflation at a future point when the economy is approaching full employment. However, the Fed possesses the same tools to fight inflation in this context as it would otherwise. It can target a higher federal funds rate to slow the economy and it can also raise the amount of required reserves that banks must hold with the Fed, although it would want to make any increases in reserves gradual, and ideally scheduled long in advance, in order to avoid disrupting the financial system.

While the effort to balance the risks from inflation with the need to sustain growth and high employment may pose problems when the economy recovers, this is always true. If the Fed were to finance a substantial stimulus package by buying and holding debt, this problem would not be qualitatively different than the problem the Fed has faced in other recoveries.

If the idea of the Federal Reserve just holding the debt sounds like a free lunch, it should, because it is. We are seeing mass unemployment right now for a simple reason — insufficient demand. The problem is not the economy’s lack of ability to produce more output, uncertainty of business owners, or a lack of access to credit. The problem is that there is not enough demand for the output that the economy could produce.

Before the downturn, this demand was generated in large part by $8 trillion in housing wealth that turned out to be illusory. While the source of the demand was illusory, the additional goods and services that the economy was producing before the recession were real. The problem that we face right now is simply finding another way to generate the same level of demand.

This is fundamentally a political problem, not an economic problem. We simply need a way to prompt additional spending from any source whatsoever. If the housing bubble re-inflated, so that people again believed they had an additional $8 trillion in equity, then we would see enough spending to bring the economy back to full employment. This is not likely to happen and would not be sustainable even if it did. (People would build more homes, leading to enough over-supply to crash the bubble, again.)

However, it certainly makes no sense for policymakers to be more worried about demand stimulated by the government than demand stimulated by housing bubble wealth. If we can just get policymakers to focus on the economy’s real problems, it will be possible to solve them.

1 Congressional Budget Office. 2010. “Budget and Economic Outlook: Fiscal Years 2011-2020.” Washington, DC: Congressional Budget Office, Table 4-8.

Dean Baker is co-director of the Center for Economic and Policy Research (CEPR). He is the author of False Profits: Recovering from the Bubble Economy. He also has a blog Beat the Press, where he discusses the media’s coverage of economic issues. This article was first published by CEPR in September 2010 under a Creative Commons license.

| Print